Independent

Thinks s/he gets paid by the post

- Joined

- Oct 28, 2006

- Messages

- 4,629

+1The bad news is: things are expected to continue to get worse.

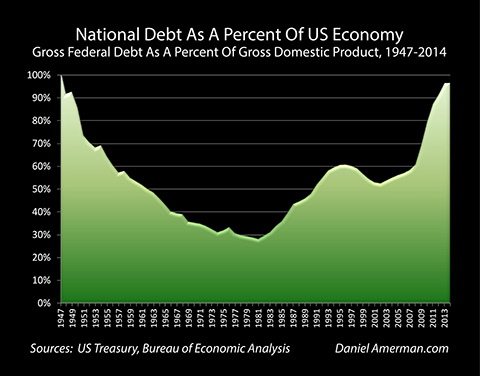

$19 trillion would be manageable if we were running annual budget surpluses today. But, we're not.

And, the outlook is bad. The US gov't has made promises to us old folk that it can't keep without tax increases. There's no political will for either benefit cuts or tax increases. Just listen to the prez candidates these days.

I don't think it's okay to say "We're no worse than some other countries." It's possible that we all go down together.

I'm not comfortable with "We can just print money". That was okay when the debt was smaller. Prior to 2008, our base money supply was about $1 trillion. (The Fed increased it a lot without kicking off inflation, but that was possible due to very unusual economic conditions.) Other things being equal, doubling the money supply doubles prices. How much would we have to increase our $1 trillion to make a dent in a $19 trillion debt?

The issue for this forum is "personal, actionable" information. Are there any practical steps an individuals can take to protect themselves if they believe there is some chance (say 10%) that this ends badly before we die?