pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

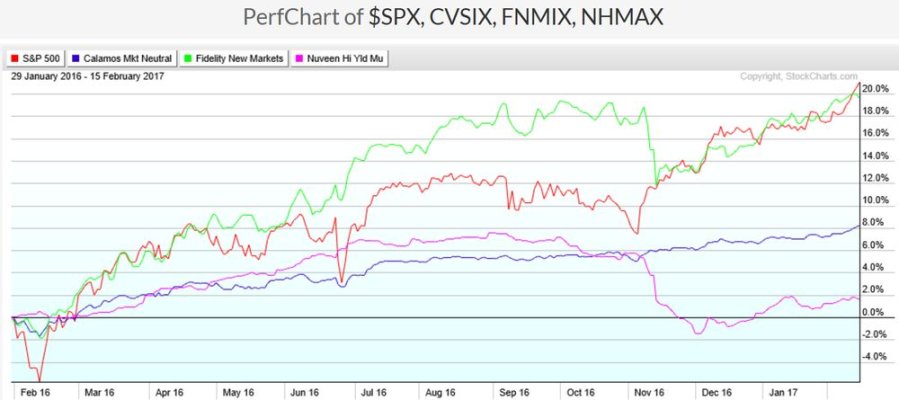

Is anyone out there using this fund? If so, what say you? Considering it as a bond fund substitute.

Of course with a $250,000 minimum if it is to be a "small portion of an already well-diversified portfolio" then it would have to be a pretty big portfolio!

This fund has a unique and complex investment approach, compared with other Vanguard funds. Its goal is to “neutralize,” or limit, the effect of stock market movement on returns. Because of this, the fund’s return is often uncorrelated to that of the stock market. Unlike other Vanguard funds, this fund uses long- and short-selling strategies, which involve specific risks not apparent in traditional mutual funds. The fund may be appropriate for a small portion of an already well-diversified portfolio.

Of course with a $250,000 minimum if it is to be a "small portion of an already well-diversified portfolio" then it would have to be a pretty big portfolio!