I do an end of year assessment of my retirement accounts.

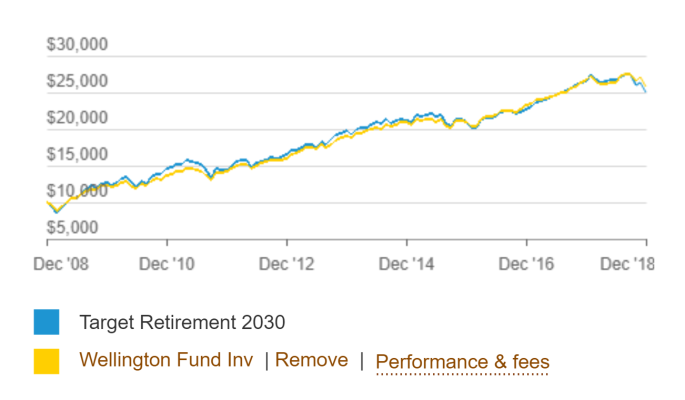

My 401K is with Vanguard. I have some of the money in Vanguard Target retirement 2030 fund with about 60/40 allocation. Note: I use the Target retirement funds to get the desired allocation that I'm looking for. My choices are limited in my company's 401K plan.

I also have some money in Vanguard Wellington, which has about a 60/40 allocation.

What I believe I observed looking at my end of year statement:

- Both funds were down for 2018, unless I'm not reading the website correctly.

- The investments in both funds were down about the same amount, which makes sense with their similar allocation.

- The Wellington funds provided dividend income for the year that basically offset their losses for the year, the Target Retirement 2030 fund did not provide any dividend income, so it was down much further for the year.

My comments:

- Am I reading my statement correctly? Did Wellington provide dividend income to offset the investment losses for the year, and did the Target Retirement 2030 fund not do this?

- I'm not a dividend or investment expert, but I like what happened with the Wellington investments in a down year. It makes me want to invest more in Wellington over other similar balanced funds.

- What are the negatives to investing in Wellington if they are heavy in dividend paying stocks?

Thanks in advance for any comments or thoughts you have on this topic.

JP

My 401K is with Vanguard. I have some of the money in Vanguard Target retirement 2030 fund with about 60/40 allocation. Note: I use the Target retirement funds to get the desired allocation that I'm looking for. My choices are limited in my company's 401K plan.

I also have some money in Vanguard Wellington, which has about a 60/40 allocation.

What I believe I observed looking at my end of year statement:

- Both funds were down for 2018, unless I'm not reading the website correctly.

- The investments in both funds were down about the same amount, which makes sense with their similar allocation.

- The Wellington funds provided dividend income for the year that basically offset their losses for the year, the Target Retirement 2030 fund did not provide any dividend income, so it was down much further for the year.

My comments:

- Am I reading my statement correctly? Did Wellington provide dividend income to offset the investment losses for the year, and did the Target Retirement 2030 fund not do this?

- I'm not a dividend or investment expert, but I like what happened with the Wellington investments in a down year. It makes me want to invest more in Wellington over other similar balanced funds.

- What are the negatives to investing in Wellington if they are heavy in dividend paying stocks?

Thanks in advance for any comments or thoughts you have on this topic.

JP