Tafkah

Recycles dryer sheets

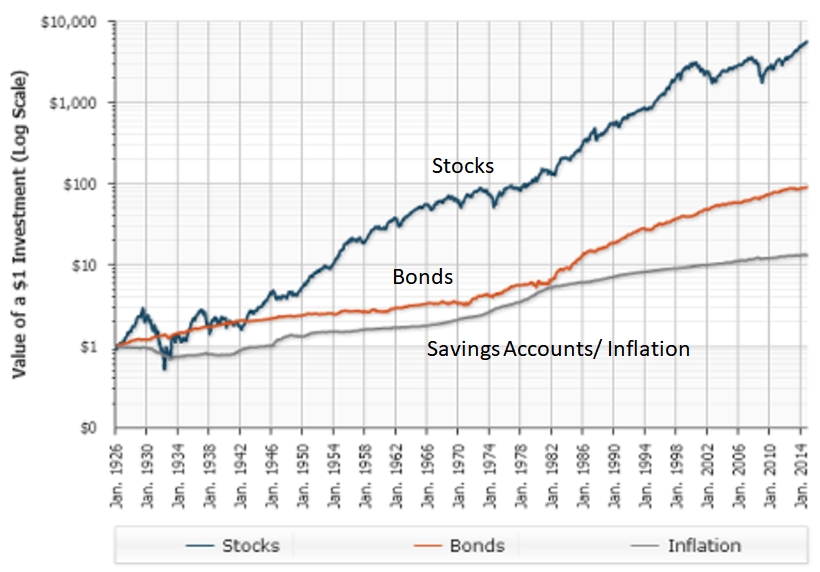

Feeling very pessimistic a few years ago, I changed my AA to 25% equities, 50% bonds and 25% cash. Sounds insanely conservative, right?

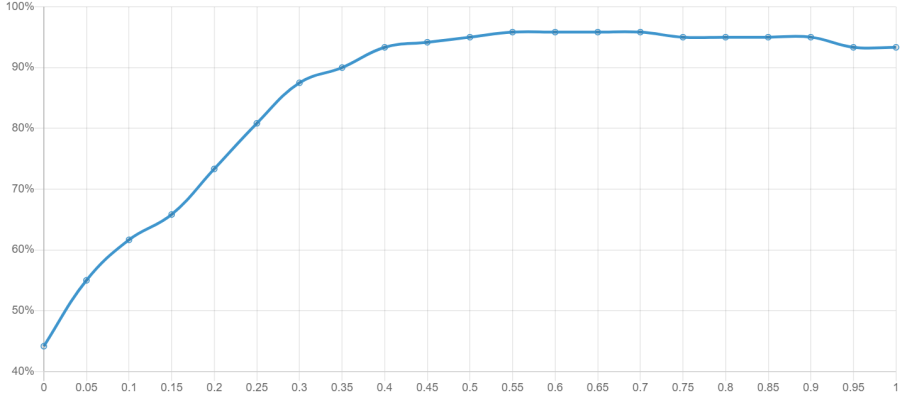

But when I input all my particulars into FI Calc, the success rate is 97.6%, even if I DOUBLE my spending and increase that with inflation. I don't have any heirs to think about, so what would be the logical argument for increasing my equity allocation and volatility?

Thanks for the help.

But when I input all my particulars into FI Calc, the success rate is 97.6%, even if I DOUBLE my spending and increase that with inflation. I don't have any heirs to think about, so what would be the logical argument for increasing my equity allocation and volatility?

Thanks for the help.