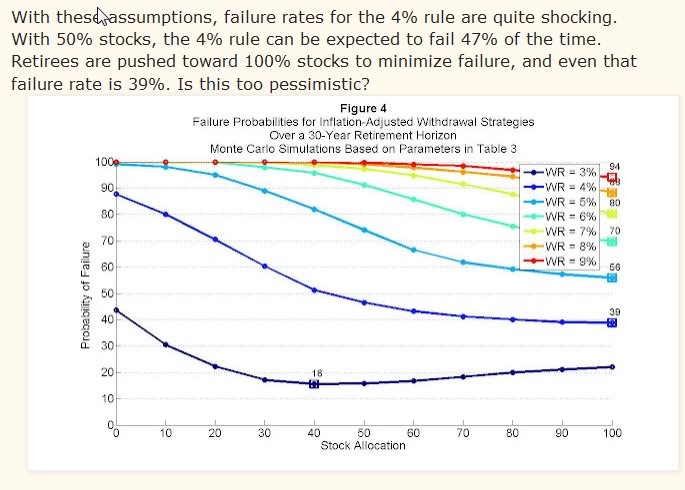

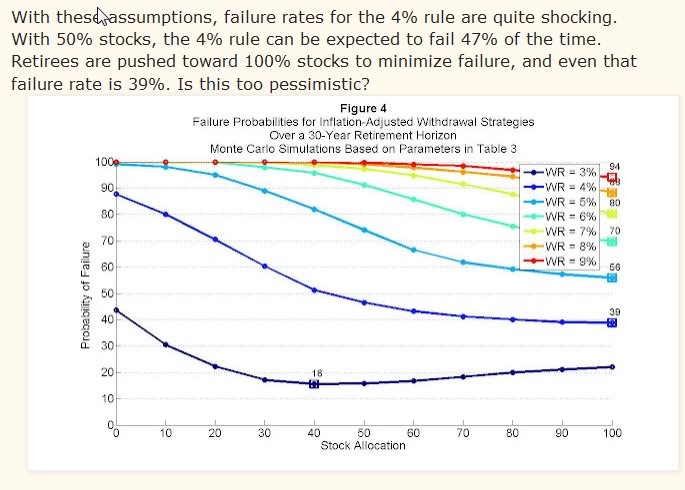

For a quick starter, do note that the assumptions here don't necessarily have to define the entire 30 year retirement period. With sequence of returns risk what happens in the early part of retirement matters a great deal more than what happens later on. Even if conditions "normalize" to the historical averages in 15 or 20 years, that will provide only a quite small amount of help to those retiring today. Wealth depletion in the mean time will be hard to overcome. It is like the worst-case scenario retiree from history: the 1966 retiree. The last half of this 30-year retirement was the 1980s and 1990s bull market, but by then it was too late, too much wealth was depleted to enjoy the recovery.