Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Jldavid47 I appreciate you sharing your views. For the first time I think I see now why some folks stay short.

But I took a different tack and laddered out to 8 years (speaking only of individual issues.)

But I did it all since Oct of last year and all at 5-5.5% plus or minus.

Folks that did not ladder when rates were higher are in a more difficult position.

I do think rates are going lower but you may get some opportunities if you are active and look at all parts of the market.

But the whole idea of a ladder is not to speculate. Jazz4Cash has this right in my view and CoCheesehead says you can find deals if you shop. I think so too.

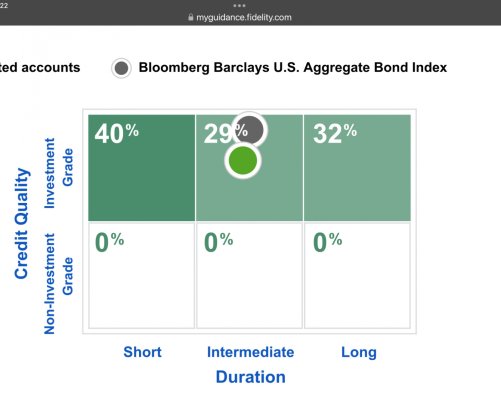

But consider this bet hedger: a "barbell" strategy. Balance your short term holdings with some quality long term holdings and fill the rest as you go. If rates go down at least the long end is sitting prettiest. If rates rise, short is good and you can extend the ladder.

Just an idea.

But I took a different tack and laddered out to 8 years (speaking only of individual issues.)

But I did it all since Oct of last year and all at 5-5.5% plus or minus.

Folks that did not ladder when rates were higher are in a more difficult position.

I do think rates are going lower but you may get some opportunities if you are active and look at all parts of the market.

But the whole idea of a ladder is not to speculate. Jazz4Cash has this right in my view and CoCheesehead says you can find deals if you shop. I think so too.

But consider this bet hedger: a "barbell" strategy. Balance your short term holdings with some quality long term holdings and fill the rest as you go. If rates go down at least the long end is sitting prettiest. If rates rise, short is good and you can extend the ladder.

Just an idea.