Freedom56

Thinks s/he gets paid by the post

First thing Monday! What would be a reasonable bid?

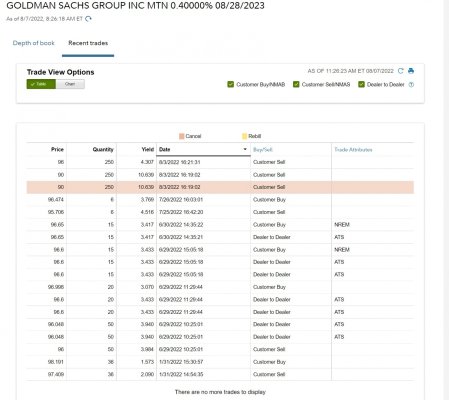

The recent trade history is shown below:

https://finra-markets.morningstar.c...64408&startdate=08/05/2021&enddate=08/05/2022

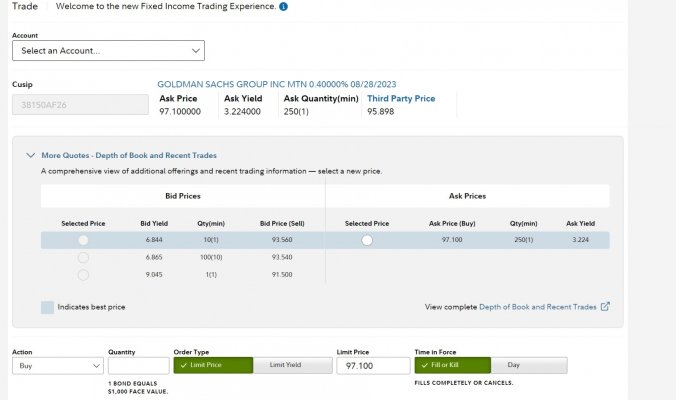

As you can see it does not trade that often and in relatively low dollar value trades. Don't expect to snag large dollar amounts. $4K-10K lots are reasonable expectations for this particular note. Also if you buy before the 15th of August, you have to pay the buyer the accrued interest for the last six months but on the 15th t of August the interest is payed back to you. I would say that a bid of $99.70 is reasonable.