copyright1997reloaded

Thinks s/he gets paid by the post

They are all gone.

w*rk got me on this one, had to teach today and then got busy with grading.

They are all gone.

I would relax. We will see many more issues either non-callable, make whole call, or callable with extended call periods like the one today from RBC. These retail issues are relatively small in size and are issued frequently. In two weeks the fed will raise the Fed funds rate another 25 basis points which will increase yields on short term treasuries and ripple through short duration corporate notes and money market funds.

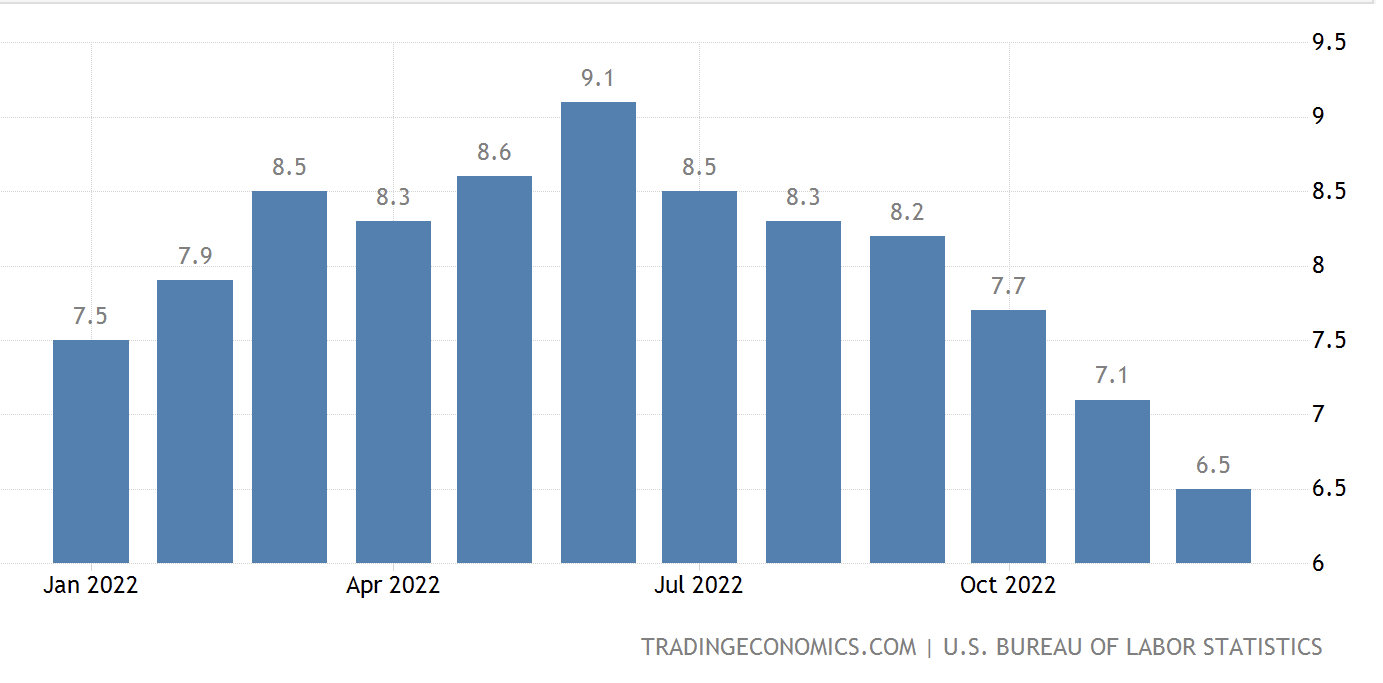

Not over but trending in the right direction? Some credible sources are saying 3-3.5% by the end of 2023, barring geopolitical upsets?Somehow I don't think inflation is nearly over. Time will tell.

Last 6 month trend is under . 5%. Yes under half a percent.Not over but trending in the right direction? Some credible sources are saying 3-3.5% by the end of 2023, barring geopolitical upsets?

Last 6 month trend is under . 5%. Yes under half a percent.

So yes, as Ken Fisher said a couple of days ago, "Inflation is deader than a doornail. Only the doornail doesn't know it."

Percentage change in the CPI index since June, annualized.Montecfo - I am not sure what you mean when you say the "TREND" is under 0.5%...

Are you saying that the SLOPE of the curve is -0.5%/month?

I am glad to see the downward move, but, I think that the y-axis scale shown on the chart makes things look better than they are. The chart needs to be displayed with y-axis from -2 to 10.

We aren't NEAR 2% yet. I hope the FED holds down the pedal for now.

Yes, and the recent decline in inflation that Montecfo refers to is why many of us following IBonds rates expect the May 2023 inflation rate component to be very low, and make IBonds less attractive once the current 6.48% period runs off.Percentage change in the CPI index since June, annualized.

Stated differently, almost all the reported inflation in the headline CPI number happened over 6 months ago.

This is determined by looking at the actual index figures, not a chart of the annual figures.

It's back this morning on Fidelity. Just placed a modest order for some.They are all gone.

It's back this morning on Fidelity. Just placed a modest order for some.

just saw this post. Looking at this at Fidelity, it doesn't show as a new issue. Looks like it is fully subscribed (sold out)?

I did the same thing. Indeed, it will be interesting to see how these get called.I have both the 6% 10 year with 2 year call protection and will have the 5.2% 10 year with 5 years of call protection after the order executes. It will become a case study to see which one in the end turns out to be a better investment.

We are likely to see more issues with call protection extended.

Jim Cramer is ranting about "A bailout loan from the Federal Home Loan Bank for a crypto bank"

https://finance.yahoo.com/news/not-business-usual-jim-cramer-130000924.html

"Silvergate received $4.3 billion from the Federal Home Loan Bank of San Francisco late last year, company filings show. The billions in liquidity provided by the FHLB in the fourth quarter alone helped La Jolla, Calif.,-based Silvergate stave off a further run on deposits. The crypto-friendly bank now holds roughly $4.6 billion in cash — the bulk of which came from Home Loan Bank advances, according to select financial metrics that Silvergate released last week."

Why is FHLB loaning $4.3 billion to Silvergate bank (a crypto bank)?

(I am holding a chunk of FHLB agency bond, Cusip 3130AUBN3).

I am not trying to shift the focus of this thread, just thought it was relevant to FHLB investment.

I did the same thing. Indeed, it will be interesting to see how these get called.

WTFJim Cramer is ranting about "A bailout loan from the Federal Home Loan Bank for a crypto bank"

https://finance.yahoo.com/news/not-business-usual-jim-cramer-130000924.html

"Silvergate received $4.3 billion from the Federal Home Loan Bank of San Francisco late last year, company filings show. The billions in liquidity provided by the FHLB in the fourth quarter alone helped La Jolla, Calif.,-based Silvergate stave off a further run on deposits. The crypto-friendly bank now holds roughly $4.6 billion in cash — the bulk of which came from Home Loan Bank advances, according to select financial metrics that Silvergate released last week."

Why is FHLB loaning $4.3 billion to Silvergate bank (a crypto bank)?

(I am holding a chunk of FHLB agency bond, Cusip 3130AUBN3).

I am not trying to shift the focus of this thread, just thought it was relevant to FHLB investment.

Thanks for the heads-up, I bought a few!!

It's back this morning on Fidelity. Just placed a modest order for some.

These have not been great investments for quite a long time. I think they still have a place especially for people who want to ladder spending to the future with a known real return.FWIW todays 10 year TIPS auction came in with a fixed 1.125% and a price of 99. A little off the recent high real yields. Evidently people are seeking inflation havens. When every ordinary Joe hops aboard and rates fall near zero I'll quit buying. Hopefully after I fill out my ladder.

These have not been great investments for quite a long time. I think they still have a place especially for people who want to ladder spending to the future with a known real return.

I own a modest number of 5 year bonds.