corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

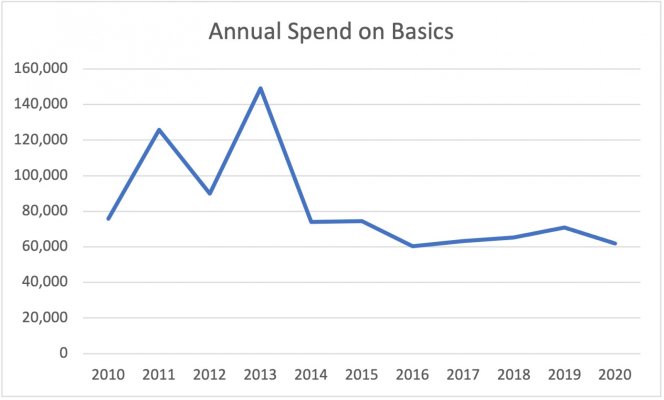

I have been closely tracking expenses since 2010. Retired this past Mar and put together a budget for retirement that I thought was reasonable. Areas that I think we overspent on were food and clothes. So I put in an amount that I thought we should spend vs. what we do spend. Ask me how that turned out. So now the "budget" (or should I call it planned expenses) reflect what we have been spending the last 2 years. Nice try, huh? At least I know we don't have to watch what we spend on a daily basis and just need to meter the big spending. Probably happier that way. Still have more money than we needed to retire, so life is good.

Just to put up the dart board:

Food: $1,500 / mo budgeted, $2048 actual over the last 2 years

Clothes: $400 / mo budgeted, $600 actual over the last 2 years (I haven't bought clothes for me in years)

I also had to bump gas up 40% because we are camping a lot and pulling my 12,000 lbs fifth wheel with a gas truck costs a lot. We weren't camping before, so didn't account for that. Truck costs $125 to fill up and I can go about 200 miles on a tank when towing.

Everything else is tracking nicely.

Just to put up the dart board:

Food: $1,500 / mo budgeted, $2048 actual over the last 2 years

Clothes: $400 / mo budgeted, $600 actual over the last 2 years (I haven't bought clothes for me in years)

I also had to bump gas up 40% because we are camping a lot and pulling my 12,000 lbs fifth wheel with a gas truck costs a lot. We weren't camping before, so didn't account for that. Truck costs $125 to fill up and I can go about 200 miles on a tank when towing.

Everything else is tracking nicely.

Last edited: