wellesly bet on a large concentration of long term bonds and lost .

what is interesting is the that while wellesley returned a mere 3% cagr since feb 2020 , fidelity balanced which is more equity laden at about 60% returned 9.67% so 100k in wellesly grew to 112,170 , 100k in fidelity balanced grew to 144,643….pretty good for fidelity balanced considering it was just 20% more equities yet more than 3x the return

spy being 100% equites grew to 159,935 a 12.67% return

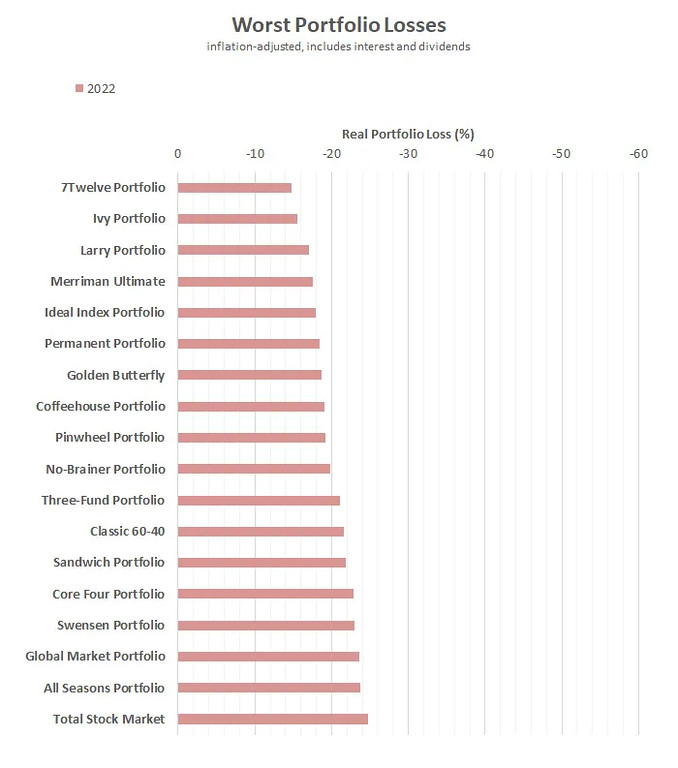

so once again the fact we had rising rates did not effect equities much while the portfolios that were designed to be defensive and mitigate these temporary dips did a lot worse

but what is interesting is that the sharpe ratio which is a measure of risk vs return has wellesly at a mere .16% while fidelity balanced fund was .55 and the s&p .93% .

the higher the number the better the risk vs reward so wellesly was barely worth the risk over that period .

ladding a bit of gold tends to help wellesley so a small 20% stake in gold , iau or gld helped things a wee bit bringing wellesley up to almost a 4% cagr and a sharpe ratio of .23 and it grew to 115,806.

that makes wellesley a bit closer to a golden butterfly portfolio.

by itself gold grew to 126,862 6.13% cagr and sharpe ratio of .35% beating wellesly by itself in risk vs reward

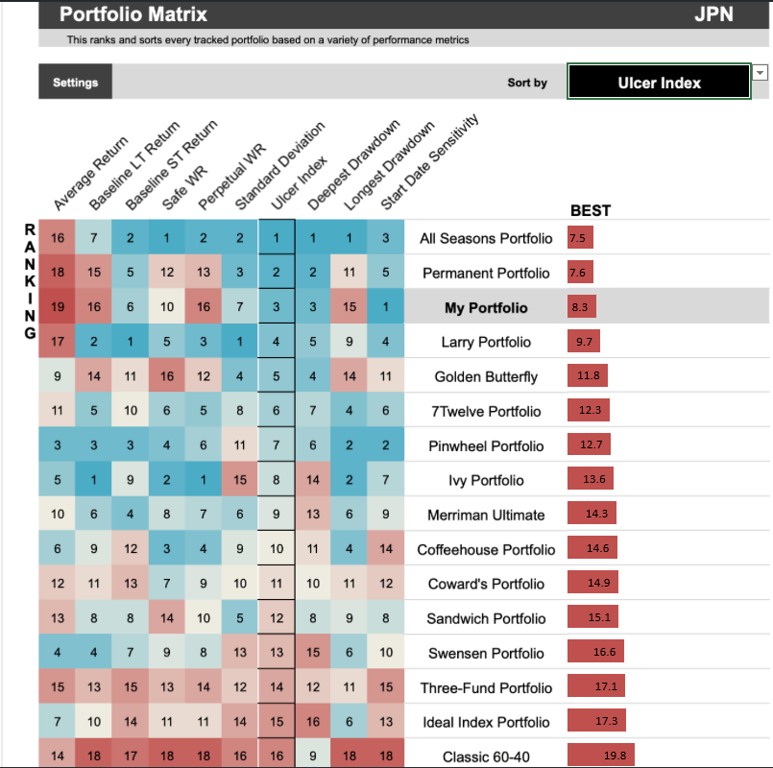

but the big brother of defensive portfolios, the permanent portfolio

which is 25% spy

25% long term bonds

25% gold

25% short term treasuries

did about the same as wellesly , clocking in at 3.44% cagr , 114,492 and a sharpe ratio of .20

so wellesly did about the same as any other defensive portfolio over that terrible period , if they held long term bonds as a defensive component

). Anyway, some of those dollars are now in cds and a corresponding amount to the stock component is in an index fund. I do not regret selling.

). Anyway, some of those dollars are now in cds and a corresponding amount to the stock component is in an index fund. I do not regret selling.