|

|

06-17-2020, 08:22 AM

06-17-2020, 08:22 AM

|

#21

|

|

Full time employment: Posting here.

Join Date: Feb 2018

Location: An Un-Organized Township of Maine

Posts: 801

|

Quote: Quote:

Originally Posted by BoodaGazelle

Donít put all of your money in tax-deferred accounts.

|

hmm, I do not know about all that. My money is totally in tax-shelters.

I have not paid into Income Taxation since 1985, paying taxes would ruin me.

Quote: Quote:

Originally Posted by Gallaher

Invest in stocks

|

Or else invest in something that pays better and keeps you sheltered from taxes.

__________________

Retired at 42 and I have been enjoying retirement for 18 years [so far].

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

06-17-2020, 08:34 AM

06-17-2020, 08:34 AM

|

#22

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,351

|

Quote: Quote:

Originally Posted by Offgrid Organic Farmer

... invest in something that pays better and keeps you sheltered from taxes.

|

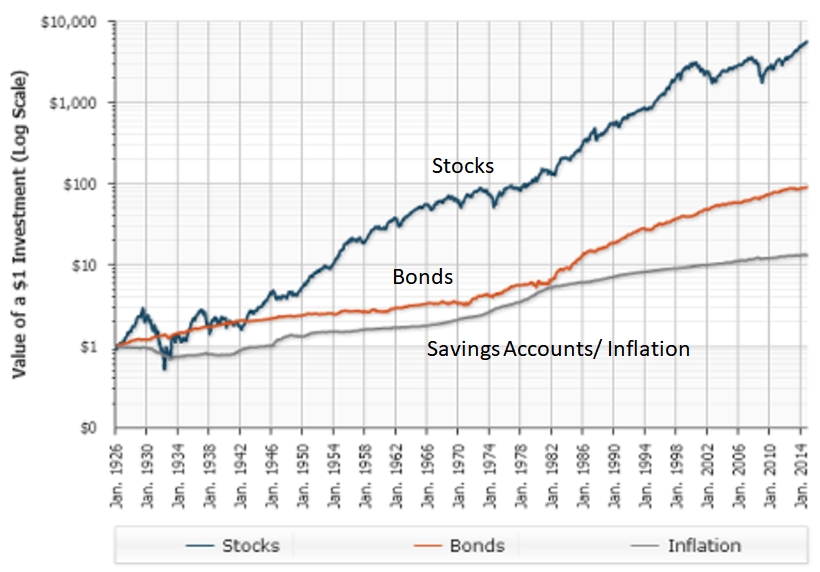

Sounds great! What is this "something" that pays better than stocks? I would like some too.

(Note that the y-axis is logarithmic. Stocks beat bonds roughly 80x.)

|

|

|

06-17-2020, 09:19 AM

06-17-2020, 09:19 AM

|

#23

|

|

Full time employment: Posting here.

Join Date: May 2013

Posts: 727

|

I'm not quite 60, but have been retired for a while so I'll offer my 2 cents anyway

Many quote LBYM, but our test on spending was always whether or not looking back in a year I'd likely be happy I spent the money. Spend your money on things that will result in lasting happiness and skip those that don't. Do this and you'll likely have the best of both worlds; plenty of savings and fulfilling experiences along the way.

There were years that we lived close to or at our means because we knew were in a special time in life that wouldn't last (location, friends, active age). Other years we didn't have the need to spend even 50% of our income.

It all comes down to using money in a way that makes you happy. I'm a car guy. I've bought numerous cars. Some have been smart financial moves, some terrible, but I don't regret any of them.

Money is just a tool...

__________________

ďIf you don't do it this year, you will be one year older when you do.Ē - Warren Miller

|

|

|

06-17-2020, 09:39 AM

06-17-2020, 09:39 AM

|

#24

|

|

Administrator

Join Date: Apr 2006

Posts: 23,038

|

Make a plan to retire early. Spell out when will you retire and how will you put the financial and non-financial pieces in place to achieve that goal. Then, work to that plan. Although you don't need to slavishly adhere to it and can make necessary revisions if events push you off course, you are far more likely to put yourself in the position to retire early if you have a plan than if you don't. (and also more likely to avoid the One More Year syndrome)

Quote: Quote:

Originally Posted by OldShooter

Sounds great! What is this "something" that pays better than stocks? I would like some too.

|

Lucky for you, I have available, for my friends only, the third tranche of a synthetic CDO that employs Bolivian coca futures as the reference security. It is denominated in Bitcoin. I'm sure you will agree that the substantial return is well worth the negligible risk.

__________________

Living an analog life in the Digital Age.

|

|

|

06-17-2020, 10:45 AM

06-17-2020, 10:45 AM

|

#25

|

|

Full time employment: Posting here.

Join Date: Feb 2018

Location: An Un-Organized Township of Maine

Posts: 801

|

Quote: Quote:

Originally Posted by OldShooter

Sounds great! What is this "something" that pays better than stocks? I would like some too.

|

I began investing in Rental Real Estate in 1985. The last year that I paid into Income Taxation.

The tax-sheltering of Rental Real Estate sheltered my salary income until I retired at 42, in 2001.

I have been enjoying my retirement the past 19 years, kind of wondering what it is going to be like when I reach SS age.

In 2016, we bought another Rental Real Estate property, so far it is paying 13%. We do not have this one setup for the tax-sheltering, as my pension income is so low that we no longer need the tax sheltering.

__________________

Retired at 42 and I have been enjoying retirement for 18 years [so far].

|

|

|

06-17-2020, 11:24 AM

06-17-2020, 11:24 AM

|

#26

|

|

Recycles dryer sheets

Join Date: Mar 2011

Posts: 120

|

I helped a friend of mine open a brokerage account to fund her retirement. I stressed as hard as I could that time was on her side (she started at 50) and she could still retire at 65, but she had to start NOW. She started with dividend stocks, investing $50 a week. I wanted to get her in the habit of paying herself first, so I ragged on her every week "did you buy something this week?" After a few months I pulled away the net, and stopped remind her. She would text me each week when she bought something. Then she'd skip a week. Then another week. Then she stopped.

She's about 58 now, and that account, which is reinvesting dividends, has about $10,000 in it. I cant make her help herself. I thought she had seen what I was able to do, with not being a high earner, and being able to retire at 65. Now she's lost years of saving and compounding, and I worry about her future.

So I would say, whatever you decide to do, start NOW and be consistent. Pay yourself first. Because once you have lost that investment, and that compounding time, you can't get it back.

|

|

|

06-17-2020, 11:40 AM

06-17-2020, 11:40 AM

|

#27

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Dec 2004

Location: the City of Subdued Excitement

Posts: 5,588

|

Take charge of your own health. Don't leave it up to your doctors.

__________________

I have outlived most of the people I don't like and I am working on the rest.

|

|

|

06-17-2020, 11:52 AM

06-17-2020, 11:52 AM

|

#28

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,351

|

Quote: Quote:

Originally Posted by Offgrid Organic Farmer

I began investing in Rental Real Estate in 1985. The last year that I paid into Income Taxation.

The tax-sheltering of Rental Real Estate sheltered my salary income until I retired at 42, in 2001.

I have been enjoying my retirement the past 19 years, kind of wondering what it is going to be like when I reach SS age.

In 2016, we bought another Rental Real Estate property, so far it is paying 13%. We do not have this one setup for the tax-sheltering, as my pension income is so low that we no longer need the tax sheltering.

|

I'll agree that actively managed, leveraged real estate has the potential to beat stocks. In 1985 when you got in, I had already been a landlord for about 15 years. I got out around 1994. Too much hassle and really not as good a deal after the tax reform act of 1986 limited depreciation deductions. Depreciation recapture is waiting in the weeds at sell time too.

Another thing that will beat stocks is buildig and running a successful business, but I guess I implicitly assumed that we were talking about passive investments here; stocks, bonds, and CDOs that employ Bolivian coca futures as the reference security.

|

|

|

06-17-2020, 12:03 PM

06-17-2020, 12:03 PM

|

#29

|

|

Full time employment: Posting here.

Join Date: Oct 2005

Posts: 503

|

Quote: Quote:

Originally Posted by Gallaher

Invest in stocks

|

you mean buy stocks at 55? sound vague

|

|

|

06-17-2020, 12:05 PM

06-17-2020, 12:05 PM

|

#30

|

|

Full time employment: Posting here.

Join Date: Oct 2005

Posts: 503

|

Quote: Quote:

Originally Posted by OldShooter

I'll agree that actively managed, leveraged real estate has the potential to beat stocks. In 1985 when you got in, I had already been a landlord for about 15 years. I got out around 1994. Too much hassle and really not as good a deal after the tax reform act of 1986 limited depreciation deductions. Depreciation recapture is waiting in the weeds at sell time too.

Another thing that will beat stocks is buildig and running a successful business, but I guess I implicitly assumed that we were talking about passive investments here; stocks, bonds, and CDOs that employ Bolivian coca futures as the reference security.

|

thanks... retire from a job then building a successful business?

|

|

|

06-17-2020, 12:21 PM

06-17-2020, 12:21 PM

|

#31

|

|

Thinks s/he gets paid by the post

Join Date: Jan 2005

Location: northern Michigan

Posts: 2,215

|

Quote: Quote:

Originally Posted by Ed_The_Gypsy

Take charge of your own health. Don't leave it up to your doctors.

|

+1000. This is probably the most valuable piece of advice of all, IMO. Doctors are great for some things, but there is so much you can do/learn on your own to help you stay healthy and avoid chronic health issues.

I wish I would have started paying more attention to my health and fitness before I retired. I'm relatively healthy and fit now (at age 65), but I had a fair amount of "catch-up" work to do after I retired 10 years ago to get this way. It would have been better if I had started making some diet and lifestyle changes at an earlier age.

|

|

|

06-17-2020, 01:02 PM

06-17-2020, 01:02 PM

|

#32

|

|

Thinks s/he gets paid by the post

Join Date: Aug 2013

Location: North

Posts: 4,043

|

Quote: Quote:

Originally Posted by Rianne

Trust your own happiness. I started feeling useless a few weeks back. Especially with this Covid thing. I was thinking ďhow am I contributing to the betterment of the world or society?Ē You know what? Take care of yourself. Be pleasant and kind to others. Enjoy your days to the best of your abilities. Accept what you cannot change and change what you can or the serenity prayer. Enjoy nature. Smile under your mask...it shows in your cheeks.

|

Sage advice from everyone but you touched on something. A good childhood friend just released a childrens book titled "Little Things" and it truly is about the little things in life. Watching children brings me back down to reality and away from the noise, because if you see...they enjoy the littlest of things, it will make thier day. Find the little things you enjoy in life and embrace those. IT likely will be something from your child hood.

Also, the don'ts as much as do's.

Don't... be complacent with your investing choices or complete lack of involvement

Don't sell unless you understand your liabilities of that sale

Don't ever pay retail, find it cheaper, refurbed, used, or a lesser product that accomplishes the same. No teenager needs a $1k iphone every year.

Don't listen to the news...I mean don't ACT on the news...unless you understand the consequences. A lot of talkers out their...well, talkin.

__________________

Time > $$$ ~ 100% equities ~ FIRE @2031

|

|

|

06-23-2020, 03:42 PM

06-23-2020, 03:42 PM

|

#33

|

|

Dryer sheet wannabe

Join Date: Jun 2018

Location: Palm Springs

Posts: 24

|

Quote: Quote:

Originally Posted by Enuff2Eat

Dream is free. Wishful thinking for me to retire early now.

Anyhow, please give us your advice, share your experiences, mistake, things you wouldn't do it again, or anything you can think of so we can learn and mentally prepare to exit our working life.

Enuff

|

Travel NOW! Read books NOW! Moving gets harder and your sight gets worse! Do not buy things besides a car that gets you here to there and a house that keeps you safe! Recycle by buying used things! Used everything! Even better, Buy experiences! Read "The Joy of Tiding" by Marie Kondo and don't chase the market. Vanguard mutual funds and move to Admiral Shares when it grows. Ditch cable. Quit any excessive habits: smoking, drinking, drugs and gambling. Get professional help now if you have any issues, and Choose a health plan that has a HSA so you can max it out every year as an extra kind of IRA to use on all Health Expenses at 65. Took me a lot of wrong turns but I'm pretty comfortable, now. My2cents

|

|

|

06-23-2020, 04:27 PM

06-23-2020, 04:27 PM

|

#34

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2013

Location: Limerick

Posts: 5,655

|

Donít forget to give back. If youíve done well in life, try to plan a certain amount of giving each month or year. There are many folks out there not as fortunate as we are.

|

|

|

06-23-2020, 04:32 PM

06-23-2020, 04:32 PM

|

#35

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2007

Posts: 14,328

|

Eat your vegetables, say your prayers, wash behind your ears.

|

|

|

06-23-2020, 04:32 PM

06-23-2020, 04:32 PM

|

#36

|

|

Full time employment: Posting here.

Join Date: Dec 2018

Posts: 966

|

Quote: Quote:

Originally Posted by Enuff2Eat

Dream is free. Wishful thinking for me to retire early now.

Anyhow, please give us your advice, share your experiences, mistake, things you wouldn't do it again, or anything you can think of so we can learn and mentally prepare to exit our working life.

Enuff

|

Best advice: People who dream about FIRE are likely unhappy with their job. Solution: Acquire new job skills and change your job.

I would acquire multiple jobs skills by changing jobs or attending classes after work. With multiple job skills, I can change change jobs easier. After 5 years in a job, my learning curve tends to flatten.

Anytime I did not like my supervisor or my job, I quit in a heartbeat and got another job to my liking. As a result, I worked for 44 years with jobs that I really enjoyed. I also have financial security and I never fret about money.

If you retire early, you have to worry about inflation, about your investments, about running out of money, etc which can be avoided by making the right career choices.

The best thing that happened to me is when I got laid off. I realized that my job skills were limited. After going back to school to acquire new job skills, I decided to acquire even more job skills to protect myself in the future and get a job that I really like instead of a job that just bring home a paycheck. Your best investment is in yourself.

The thrill that I got by telling a supervisor that I got a better job somewhere else is priceless. You control your own destiny but you have to take the initiative.

|

|

|

06-23-2020, 04:42 PM

06-23-2020, 04:42 PM

|

#37

|

|

Recycles dryer sheets

Join Date: Jul 2018

Location: Topanga

Posts: 314

|

My advice for any young person:

1. Travel. Those who waited until now to take that "trip of a lifetime" can't because of travel restrictions. Travel for experience is a great investment especially if you can do it with your kids. Build memories.

2. Don't be linear. Don't build a career based on a straight line just because you need to do things the way everyone else tells you you have to. "Retire" several times before you do it permanently.

3. Work to live don't live to work.

And of course: LBYM, pay yourself first, don't invest on whim, and don't think you are smarter than everyone else cuz yer not.

|

|

|

06-23-2020, 05:39 PM

06-23-2020, 05:39 PM

|

#38

|

|

Recycles dryer sheets

Join Date: Feb 2014

Location: Austin

Posts: 247

|

The best advice I ever received was to have a low tolerance for passionless living. In my mind, the reasons to retire early is so that you can do the things that are important to you. Itís good to remember, though, that you donít have to retire to start doing the things that are important.

|

|

|

06-23-2020, 05:49 PM

06-23-2020, 05:49 PM

|

#39

|

|

Thinks s/he gets paid by the post

Join Date: Apr 2011

Posts: 2,974

|

Seek out some adventure in your life while you're young. Live/work abroad if you can.

__________________

Tick tick tick tock goes the clock on the wall as we're dancing the evening away -- Tick Tock Polka

|

|

|

06-23-2020, 06:59 PM

06-23-2020, 06:59 PM

|

#40

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2017

Posts: 2,555

|

Quote: Quote:

Originally Posted by Offgrid Organic Farmer

hmm, I do not know about all that. My money is totally in tax-shelters.

I have not paid into Income Taxation since 1985, paying taxes would ruin me.

Or else invest in something that pays better and keeps you sheltered from taxes.

|

Your money is not in tax-sheltered accounts, it's in tax-sheltered investments (real estate). Big difference. If one wants to RE, and has most/all of his/her assets in tax-deferred accounts, there may be no way to generate the income needed to RE, without paying penalties on early distributions. A problem many here learned far too late. 72t only takes you so far, and most here would need at least $3M invested in tax-sheltered accounts to be able to FIRE under 72t and maintain their desired lifestyle. I have 1/3 of my assets in taxable accounts, and my plan is to manage income in such a way that I pay no to very little federal taxes from 55 to 59.5, while maintaining a $120K annual income stream. It's easily possible with diversified taxable accounts in MFs or ETFs. As the years after 59.5 roll by, the LTCGs on taxable accounts will have been mostly realized, and I'll focus on selling as many tax-deferred assets as possible (while staying in a low tax bracket) prior to SS and RMDs.

Offgrid - in your case, you're deferring taxes. When you sell your properties, you might have to pay capital gains on your profits (this is super common in high-appreciation metro areas); if you're in rural America, you may slide with little appreciation and little taxes.

__________________

Balance in everything.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|