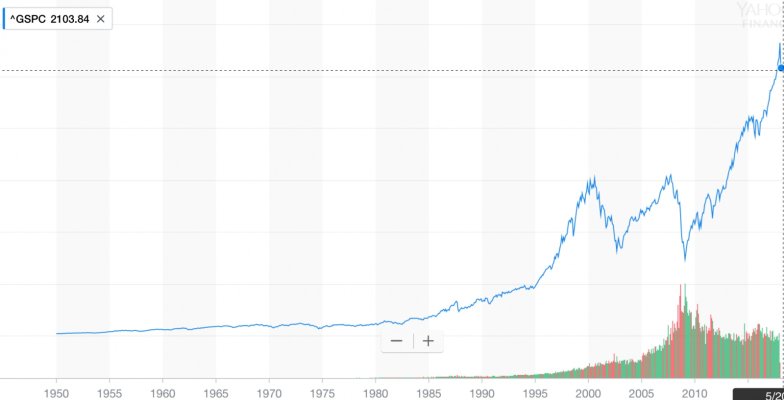

Let it ride....

#2 - Let it ride, I have stayed the course through several of these and each time I have avoided the so called experts telling me that now is the time to sell or rebalance. In the end, I let it ride and have been very fortunate so far. Another bumpy ride, kind of expected it, so time to hang on and watch, but not so much that you miss enjoying life everyday.

#2 - Let it ride, I have stayed the course through several of these and each time I have avoided the so called experts telling me that now is the time to sell or rebalance. In the end, I let it ride and have been very fortunate so far. Another bumpy ride, kind of expected it, so time to hang on and watch, but not so much that you miss enjoying life everyday.