nearing 30, single and renting!

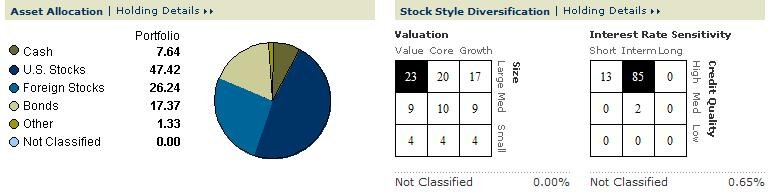

Asset Allocation:

Stocks

15% - US Total Mkt

10% - US Small Value

15% - EAFE

10% - Foreign Mid/Small Value - TBGVX - Hedged(exploring alternatives)

10% - EM

Alternative Asset Classes - still equity like

10% - REIT Idx

10% - Berkshire Hathaway

5% - Commodities

Bonds

5% - TIPs

5% - Intermediate Bond

5% - Short Term Bonds

-h

Asset Allocation:

Stocks

15% - US Total Mkt

10% - US Small Value

15% - EAFE

10% - Foreign Mid/Small Value - TBGVX - Hedged(exploring alternatives)

10% - EM

Alternative Asset Classes - still equity like

10% - REIT Idx

10% - Berkshire Hathaway

5% - Commodities

Bonds

5% - TIPs

5% - Intermediate Bond

5% - Short Term Bonds

-h