urn2bfree

Full time employment: Posting here.

- Joined

- Feb 14, 2011

- Messages

- 852

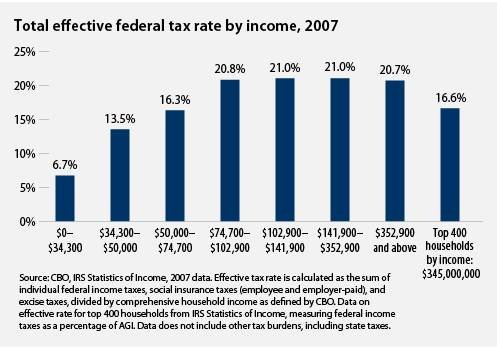

What do you think is a good number to use in estimating tax burden in retirement? I hear repeatedly that taxes go down significantly with retirement. I think I have a good idea of our spending of after tax money as far as one can estimate such things, but when using any calculation of SWR you have to estimate the PRE tax amount of money. SO what is a fair number to use? Feel free to give ranges, as in --If your expenses are between $XX and $YY USE z% and use w% if some other range, etc.