Yes, that is a good way to look at it from an income perspective. Except the numbers would be 0.2200+0.1930+0.1927+0.1698 or 0.7755 and in relation to the $29.95 value at 12/31/2021 a 2.6% yield. By comparison, today a 2-year CD yields 4.75%.

If you are focused solely on income, Wellesley or Wellington are probably poor choices in that while they are both fine funds they are not a suitable substitute for CDs. They have a lot more risk than CDs and their income distributions are a lot less than CDs today.

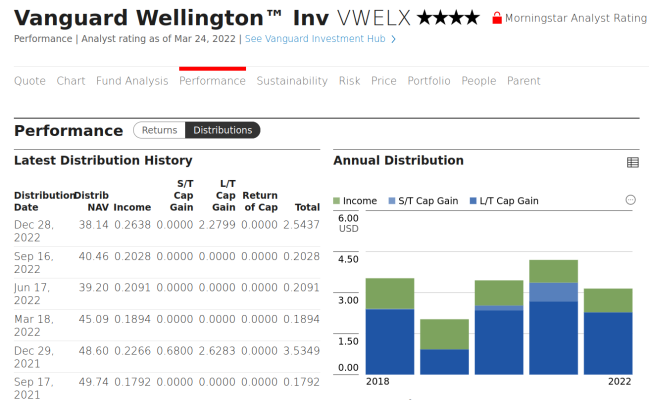

| Type $/Share Payable date Record date Reinvest date Reinvest price |

| Dividend $0.220000 12/20/2022 12/16/2022 12/19/2022 $24.60 |

| LT Cap Gain $1.101248 12/20/2022 12/16/2022 12/19/2022 $24.60 |

| Dividend $0.193000 09/19/2022 09/15/2022 09/16/2022 $25.31 |

| Dividend $0.192700 06/21/2022 06/16/2022 06/17/2022 $25.22 |

| Dividend $0.169800 03/23/2022 03/21/2022 03/22/2022 $27.62 |

Is her account at Vanguard an IRA or a taxable account?

If the CD money that you are looking to invest in the OP is taxable account money (not in an IRA) AND her Vanguard account is a taxable account then you could transfer the CD money there and start investing. It would probably be easier if her Vanguard account is a brokerage account rather than a mutual fund account.. she would have more investment choices available to her.