atmsmshr

Full time employment: Posting here.

Glad to see someone else is a fan of Fidelity's FUAMX. When I did my 401k to IRA rollover in January - placed majority of it into this intermediate Treasury bond fund. No fees - and well, if Treasuries become worthless we are down to beans and bullets anyway. While doing nothing but pondering if/how to trade some risk and chase a higher yield, covid came along and kept me from doing anything. Very pleased with my indecisive/utterly brilliant/dumb lucky inaction and the YTD return.

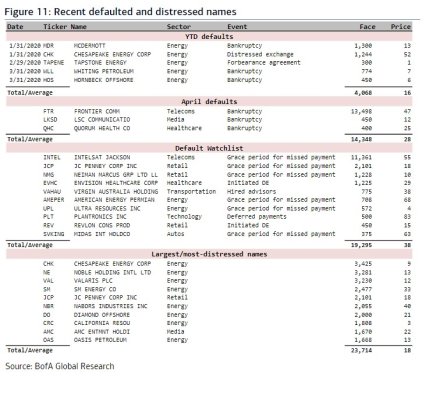

Going forward, I think there is a lot of pain coming in the financial world, from zombie companies, more defaults and bankruptcies that are starting to show up, and remixing of commercial real estate as the telework becomes the new normal. Commercial bond downgrades, defaults and haircuts should start showing up in force in the second half of the year. As a result, I won't buy a mixed bond fund in the near term. Muni bond are probably going to get a whacking as tax base dries up from any tourist tax, commercial and private real estate tax. For those cities that built mega sports stadiums on taxpayers dime that are now closed down this season - ouch.

CDs are probably better, but may have some risk of being illiquid for a time if underwriters go underwater.

Recognizing that rates have to inevitably rise, I have thought about buying Treasuries direct and some other rate juicers, but will probably stick with easily bought and sold FUAMX bond fund for the time being.

Boring and conservative.

Going forward, I think there is a lot of pain coming in the financial world, from zombie companies, more defaults and bankruptcies that are starting to show up, and remixing of commercial real estate as the telework becomes the new normal. Commercial bond downgrades, defaults and haircuts should start showing up in force in the second half of the year. As a result, I won't buy a mixed bond fund in the near term. Muni bond are probably going to get a whacking as tax base dries up from any tourist tax, commercial and private real estate tax. For those cities that built mega sports stadiums on taxpayers dime that are now closed down this season - ouch.

CDs are probably better, but may have some risk of being illiquid for a time if underwriters go underwater.

Recognizing that rates have to inevitably rise, I have thought about buying Treasuries direct and some other rate juicers, but will probably stick with easily bought and sold FUAMX bond fund for the time being.

Boring and conservative.

Last edited: