Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

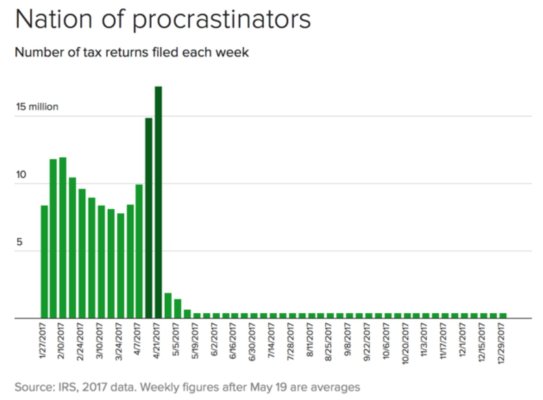

I've always done my Fed and State income taxes in early Feb. If I have a refund coming, I file as soon as I'm certain I have everything and it's all correct. However, I deliberately plan to owe so more often than not I have waited to file "amount due" a few days before the mid Apr deadline. It appears from the graph below, somewhat bimodal, others follow the same filing thought process. Obviously procrastinators fall in the last few weeks, along with those who plan to wait.

When I was young and stupid, I filed late thinking the IRS would be so swamped with returns they had less chance of auditing. I see now that probably wasn't the case anyway. Now I file late because I'm waiting on first quarter dividends to pay estimated taxes.

Too soon old, too late smart...

When I was young and stupid, I filed late thinking the IRS would be so swamped with returns they had less chance of auditing. I see now that probably wasn't the case anyway. Now I file late because I'm waiting on first quarter dividends to pay estimated taxes.

Too soon old, too late smart...

About one in five tax filers waits until the last two weeks before the filing deadline to file their taxes.

"We process about a third of all volume in April," said a spokesperson for the Internal Revenue Service. That includes the people who file extensions in April and the return itself later in the year.