pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

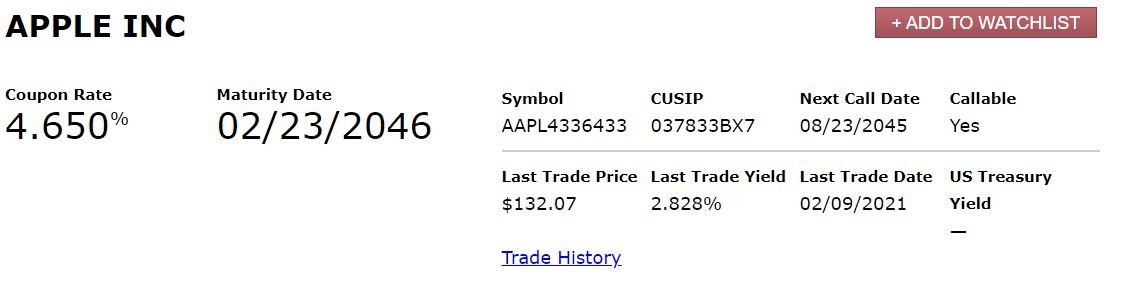

.... if you don't like risk even Apple is paying 4.65%... just now looked it up...

What is the price for that Apple bond that is paying 4.65%?

132.3 for Apple 4.65%...

So while that Apple bond may be paying 4.65% because you have to pay so much more than par to buy it, it is only yielding 2.828%.

Attachments

Last edited: