You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Where for reasonable returns

- Thread starter bobbee25

- Start date

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

There are ETFs that focus on stable large companies that provide consistent dividends.

Well the OP posed a good question that many of us are seeking the answer to.

However, the real concern here is: What does "reasonably safe principal" actually mean to each of us, and how do we apply it to our individual situations.

As most of us know, anything other than CD's and savings bonds, such as stocks, ETF's, and bonds, carry a certain degree of risk, and the greater the risk, the greater the reward.

I happen to like stocks like Chevron (CVX), ExxonMobil (XOM), McDonald's (MCD), and agree that there are some nice mutual funds and ETF's that also offer decent dividends; however, they do carry risk of principal loss in a down market, so time horizon is important.

However, the real concern here is: What does "reasonably safe principal" actually mean to each of us, and how do we apply it to our individual situations.

As most of us know, anything other than CD's and savings bonds, such as stocks, ETF's, and bonds, carry a certain degree of risk, and the greater the risk, the greater the reward.

I happen to like stocks like Chevron (CVX), ExxonMobil (XOM), McDonald's (MCD), and agree that there are some nice mutual funds and ETF's that also offer decent dividends; however, they do carry risk of principal loss in a down market, so time horizon is important.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

In addition to dividend paying stocks, I like intermediate term investment grade and high yield corporate bond funds for income, recognizing that they do have credit risk and interest rate risk compared to FDIC insured CDs.

Vanguard Intermediate-Term Investment-Grade Fund Admiral Shares have a yield of 2.14% and an average duration of 5.4 and the Vanguard High-Yield Corporate Fund Admiral Shares has a yield of 4.97% and an average duration of 4.4.

So an 80/20 mix would have about a 2.7% yield. All of the above are SEC yields; distribution yields are higher.

Vanguard Intermediate-Term Investment-Grade Fund Admiral Shares have a yield of 2.14% and an average duration of 5.4 and the Vanguard High-Yield Corporate Fund Admiral Shares has a yield of 4.97% and an average duration of 4.4.

So an 80/20 mix would have about a 2.7% yield. All of the above are SEC yields; distribution yields are higher.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The $64,000 question du jour (since interest rates hit the floor), and an indication of short term/market timing behavior. Nothing wrong with that if you can accurately predict (not follow) sector rotation. Far more people think they (or their broker) can predict often enough to come out ahead - than actually can by a wide margin. That's been confirmed objectively over and over through the years.

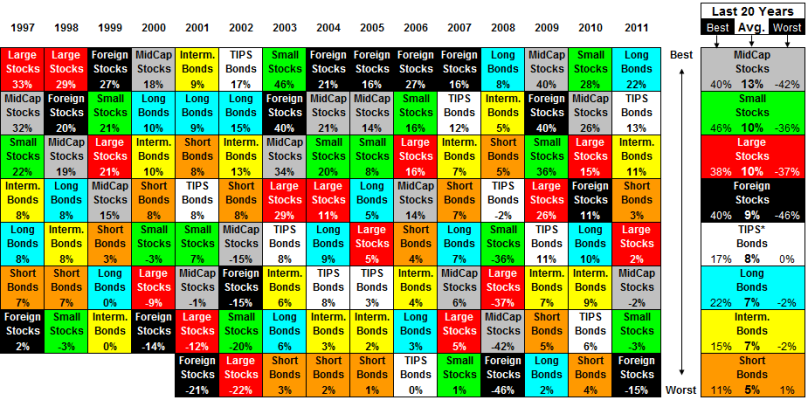

Dividend stocks seems to be the most common answer these days for those who don't 'like' bonds, and there's nothing wrong with going that route. But you're just changing your AA, dividend stocks are simply not an equivalent to bonds. Note bond returns in the table below, lots of people "urgently" switched out of bonds over the past few years. And compare the long term (right hand column) to the individual years.

There's still no 'free lunch.' Higher returns goes with higher risk/volatility, that relationship is not by accident in the long run - see avatar left.

Best of luck whatever you decide...

Dividend stocks seems to be the most common answer these days for those who don't 'like' bonds, and there's nothing wrong with going that route. But you're just changing your AA, dividend stocks are simply not an equivalent to bonds. Note bond returns in the table below, lots of people "urgently" switched out of bonds over the past few years. And compare the long term (right hand column) to the individual years.

There's still no 'free lunch.' Higher returns goes with higher risk/volatility, that relationship is not by accident in the long run - see avatar left.

Best of luck whatever you decide...

Attachments

Last edited:

nun

Thinks s/he gets paid by the post

- Joined

- Feb 17, 2006

- Messages

- 4,872

Interest income at historical lows, so you'll have to take on some principal risk if you want returns greater than that 1.7%.

psst Wellesley will get you there using dividend stocks and high quality corporate bonds. But I'd make sure you have sufficient cash to ride out bad down turns or other sources of reliable income like SS, pensions, annuities or rent.

psst Wellesley will get you there using dividend stocks and high quality corporate bonds. But I'd make sure you have sufficient cash to ride out bad down turns or other sources of reliable income like SS, pensions, annuities or rent.

I use preferred stocks for higher returns. I choose cumulative ones from good companies (mostly - although I have a couple that are questionable but I am sometimes tempted by the greater returns to take on more risk). For me this is a reasonable safety of principal as the stocks have a call value and I try to stay beneath or not too far above the call value when purchasing.

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Lots of caveats, but have you considered I-Bonds? Probably paying a whole 0.0% right now, BUT with the inflation factor, sometimes (six months at a time) these may pay more than just about anything "safe". If you don't know about these bonds, read up well first - sometimes they are the best deal in town. As always, YMMV and buyer beware.

W2R

Moderator Emeritus

pssst.... Wellesley!

Right, UncleMick?

Right, UncleMick?

freebird5825

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I always got a big kick out of this story...Darts anyone ?

Investor Home - The Wall Street Journal Dartboard Contest

In reality, I am a risk averse investor and like to use muni bond funds to form my comfort zone for boring steady returns. I also despise paying taxes on my investments, so the muni bond fund vehicle w*rks well for me. YMMV

AA = 33/64/3 as of today

Investor Home - The Wall Street Journal Dartboard Contest

In reality, I am a risk averse investor and like to use muni bond funds to form my comfort zone for boring steady returns. I also despise paying taxes on my investments, so the muni bond fund vehicle w*rks well for me. YMMV

AA = 33/64/3 as of today

Perhaps a blend of the following is something to consider. However, this is meant for a long term income stream with considerable risk over just holding CDs.

25% Floating Rate Fund (Fidelity)

25% Short Term Bond Fund (Vang)

25% High Yield Bond Fund

25% CDs/Money Market Fund/Bank Savings Acct (Ally, AMEX, etc.)

25% Floating Rate Fund (Fidelity)

25% Short Term Bond Fund (Vang)

25% High Yield Bond Fund

25% CDs/Money Market Fund/Bank Savings Acct (Ally, AMEX, etc.)

mathjak107

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 27, 2005

- Messages

- 6,204

i use a combination of different types of bond and income funds.

a few act like stocks such as fidelity capital and income and new market income but are less volatile.

when rates start to rise ill use a different allocation.

right now the difference i have gotten over cd's is about 9x this year and about 4x last year and so on and so on. even if i give 5 to 10% back when rates rise who cares. im so much further ahead it pays even with the risk of a drop before i change allocations at some point out on the horizon..

a few act like stocks such as fidelity capital and income and new market income but are less volatile.

when rates start to rise ill use a different allocation.

right now the difference i have gotten over cd's is about 9x this year and about 4x last year and so on and so on. even if i give 5 to 10% back when rates rise who cares. im so much further ahead it pays even with the risk of a drop before i change allocations at some point out on the horizon..

Throwdownmyaceinthehole

Recycles dryer sheets

- Joined

- May 20, 2012

- Messages

- 421

What's the thought on Everbank CD's? I have a bit of money in an Aussie savings account and I'm getting 5% interest. I know there is exchange gain/loss issues, not to mention any Aus tax I will end up having to pay.

Last edited:

obgyn65

Thinks s/he gets paid by the post

I am also very conservative with my investments and I have CDs and munis mainly. You can find a few good munis at the moment.

I have a 5 year CD ladder but these 1.7 type rates don't provide for much income. Where can I get a better return with reasonably safe principal.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

What's the thought on Everbank CD's? I have a bit of money in an Aussie savings account and I'm getting 5% interest. I know there is exchange gain/loss issues, not to mention any Aus tax I will end up having to pay.

Interesting idea - but if you hedged the fx risk and paid the Aus tax, how much yield would be left to be repatriated to the US to be used for living expenses?

Lots of caveats, but have you considered I-Bonds? Probably paying a whole 0.0% right now, BUT with the inflation factor, sometimes (six months at a time) these may pay more than just about anything "safe". If you don't know about these bonds, read up well first - sometimes they are the best deal in town. As always, YMMV and buyer beware.

+1

Currently paying 1.76% for the next 6 months and have been as low as 0% for a 6 month period.

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

Perhaps a blend of the following is something to consider. However, this is meant for a long term income stream with considerable risk over just holding CDs.

25% Floating Rate Fund (Fidelity)

25% Short Term Bond Fund (Vang)

25% High Yield Bond Fund

25% CDs/Money Market Fund/Bank Savings Acct (Ally, AMEX, etc.)

You aren't kidding about "considerable risk." This mix would be 50% junk.

"You aren't kidding about "considerable risk." This mix would be 50% junk."

-------------------------------------------------------------------------------

Over a long term (10-15 years) withdrawal plan, I would consider this mix to be part(maybe 20%) of a strategic plan to encompass a total portfolio of equities, real estate, and bonds. The suggestion was in no part meant to be for short duration.

-------------------------------------------------------------------------------

Over a long term (10-15 years) withdrawal plan, I would consider this mix to be part(maybe 20%) of a strategic plan to encompass a total portfolio of equities, real estate, and bonds. The suggestion was in no part meant to be for short duration.

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

So, what would you suggest for income Brewer? Some of us need income to pay the bills.

Same as always: a nicely diversified portfolio of fixed income, equities and alternatives (commodities, merger arb, etc.) that will throw off income and capital gains over time. There is nothing magic about income.

Similar threads

- Replies

- 29

- Views

- 2K

- Replies

- 35

- Views

- 2K

- Replies

- 35

- Views

- 2K

Latest posts

-

-

-

-

-

-

-

-

What new series are you watching? *No Spoilers, Please*

- Latest: sengsational

-