FinanceDude

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Aug 3, 2006

- Messages

- 12,483

Simple Answer: Anywhere BUT your local bank.........

Got a flyer in the mail today for a 12 month CD @2.65%. What? This company is named First Financial Group and is subtitled "The Original CD Locator and Financial Service Co". States all accounts are FDIC insured. I think the disclaimer of interest is "Yield and deposit amount subject to availability". It was too late to call today but I certainly will tomorrow, but probably closed on Saturday.

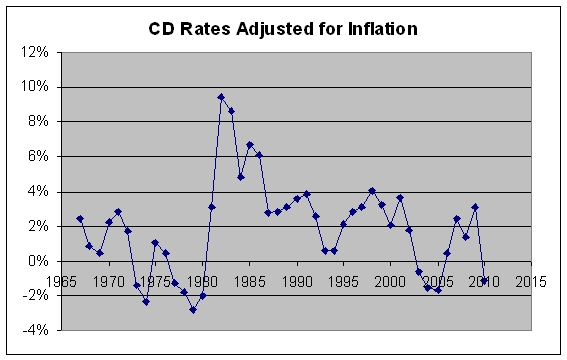

It helps to look at the overall portfolio. I'd rather have negative after inflation returns on minor cash positions while getting good returns on equities then the other way around.Sad to think we (at least JOHNNIE36 and I) would salivate over 2.65% interest! Definitely something wrong with today's economy (or at least the way our gummint is handling it). I long for the good old days when CDs would at least keep up with inflation (real inflation - not what the gummint says it is).

...

I am doing a 5 year cd with Allied (2 month penalty) at 1.75% I think.

That's way better than my other cash holdings where I pay ordinary taxes on interest income every year.

AndrewJackson said:I am doing a 5 year cd with Allied (2 month penalty) at 1.75% I think.

I don't think they have either - at least not after taxes.I'm not sure CDs have ever consistently beat inflation...

I think it is these times (recently 1999 and 2000; 2004-2006) that people remember getting a sweet deal on CDs.

Yeah like 3.6% + inflation in 2000. Part of the deal was they were new, so people had to be encouraged to buy them. I think you could get real 3% TIPs too.Wasn't this around the time (~1999) when you could get 3% real Ibonds? That was before I started working (=no money to invest) but it seems like a killer deal.

The formula provided 1.76% interest in the last 6 month period. This is probably the minimum.Composite rate = [fixed rate + (2 x inflation rate) + (fixed rate x inflation rate)

Several of us have been maxing out our yearly ibond investment since right now it is an excellent place to keep cash if you don't need it for at least a year.Well, this thread is a little old, but I'll try to bump it.

I have known about treasurydirect and ibonds for quite a while, but apparently like many here, haven't really investigated them. I just read more, and this looks like a great place to keep cash (as long as you don't need it for at least a year, as apparently you can't cash the bond till then).

So, if I understand everything correctly:

1) You can never lose principal

2) looks like you make about 1.76% interest for 2013

3) You can defer paying fed tax on interest until you cash em, like when you are in a lower tax bracket

4) They are state tax free

5) they have a 3 month interest penalty if cashed in before 5 years

6) Inflation protection (duh)

7) you can buy $10k/year electronically

8) You can buy $5k/year from a tax return

The only thing I don't completely understand is the buying of these bonds thru your tax return. If I don't get $5k back I assume I can't buy this $5k worth of bonds? (yes, that seems like an obviousl question) So, does that mean I would HAVE to overpay by $5k to be able to do this? (again, seems like an obvious question, but who knows?)

I am seriously thinking about putting together a ladder of these for my cash dollars....

Some folks here have done the tax refund thing in IBonds, but yes, you would need to overpay enough to have a considerable refund to take advantage. We don't bother with that route, but if someone had overpaid that much anyway, I can't see why they might take advantage of it.

The only thing I don't completely understand is the buying of these bonds thru your tax return. If I don't get $5k back I assume I can't buy this $5k worth of bonds? (yes, that seems like an obviousl question) So, does that mean I would HAVE to overpay by $5k to be able to do this? (again, seems like an obvious question, but who knows?)

I am seriously thinking about putting together a ladder of these for my cash dollars....

I don't know. I was under the impression it would be taken out of your refund, and as far as I know the 1040 doesn't have a way for you to add money for a refund.You can't just send the add'l $5K (or difference or whatever) with your tax return?

I do this frequently but learned the hard way with Band of America because they charge a fee to transfer funds. So, the way out of this is to request the transfer through ALLY. So when I want to transfer funds from BOA to ALLY, I ask ALLY to request the funds from BOA. No fee. Also, I have noticed that funds requested by ALLY from BOA only take two days as opposed to three days. Maybe not guaranteed, but common.

Got a flyer in the mail today for a 12 month CD @2.65%. What? This company is named First Financial Group and is subtitled "The Original CD Locator and Financial Service Co". States all accounts are FDIC insured. I think the disclaimer of interest is "Yield and deposit amount subject to availability". It was too late to call today but I certainly will tomorrow, but probably closed on Saturday.

I am doing a 5 year cd with Allied (2 month penalty) at 1.75% I think.

, but what people were saying was that when the interest rates start rising and customers start calling Ally to withdraw their CD's, Ally will be able to decline your request 'to break' the CD until the term is up.

, but what people were saying was that when the interest rates start rising and customers start calling Ally to withdraw their CD's, Ally will be able to decline your request 'to break' the CD until the term is up.

I think last year Ally changed the fine print of their CD's. Not sure where I read the discussion about it. It was either on the Bogleheads or some banking blog. Anyway, the fine print *before* the change said 2-mo. penalty only, but *after* the change has an addition 'withdrawals at our discretion'. I have NOT read the print personally on my new Ally CD, but what people were saying was that when the interest rates start rising and customers start calling Ally to withdraw their CD's, Ally will be able to decline your request 'to break' the CD until the term is up.