You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

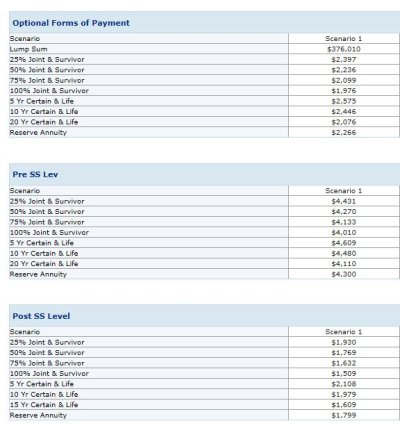

Which form of payment for pension?

- Thread starter Slow But Steady

- Start date

Slow But Steady

Recycles dryer sheets

papadad111

Thinks s/he gets paid by the post

- Joined

- Oct 4, 2007

- Messages

- 1,135

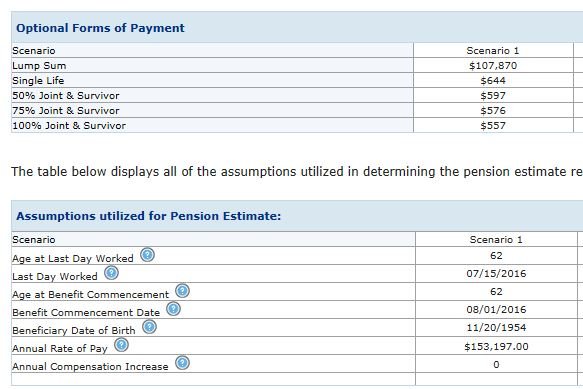

I would take the lump sum in both cases. But that's with my own knowledge of my other financial assets.

From a pure annuity standpoint the payout rate is not much different from what you could get from an insurance company, i.e., take the lump sum and buy an annuity. Your return would be fairly close, within 50bbp.

There are considerations such as taxes on pensions depending where u live etc.

Would need to understand your situation further to give you better advice.

From a pure annuity standpoint the payout rate is not much different from what you could get from an insurance company, i.e., take the lump sum and buy an annuity. Your return would be fairly close, within 50bbp.

There are considerations such as taxes on pensions depending where u live etc.

Would need to understand your situation further to give you better advice.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I went through this and decided on the 100% survivor since DW and I are both in good health, have some reasonable wealth and good family longevity as a result at this juncture should outlive the mortality tables. Plus it will provide a steady source of income should investment results lag expectations. YMMV.

What is the "Reserve Annuity"?

What is the "Reserve Annuity"?

Big_Hitter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The reserve annuity is probably a cash refund annuity.

I also have a question - what is the leveling period? Is it 65 or SSNRA?

I also have a question - what is the leveling period? Is it 65 or SSNRA?

What is your and your wife's age? Is the pension stable and secure? At what age to you plant to take SS? Do you have assets in addition to this and SS for retirement? Not looking for you to answer publicly, but I think you have to look at the big picture.

Based on what I see above, and assuming the pension is secure, I would take the 100% Joint/Survivor for the larger one, and the single life for the smaller one.

It assures the survivor has income and if the smaller one goes because you die first, chances are her expenses would decrease by at least that amount.

Based on what I see above, and assuming the pension is secure, I would take the 100% Joint/Survivor for the larger one, and the single life for the smaller one.

It assures the survivor has income and if the smaller one goes because you die first, chances are her expenses would decrease by at least that amount.

Slow But Steady

Recycles dryer sheets

Thanks for your responses.

I am 62 and my wife is 61. She has been retired for about two years. We elected to take her pension as a lump sum, rolled over into an IRA.

We live in Texas, so no state income tax.

The pensions are well funded, and are protected by PBGC. I guess that means they are fairly secure.

The reserve annuity is indeed a cash refund annuity.

In terms of our financial situation, the total of these two lump sum amounts would just be a small fraction of our retirement assets. Most of our assets are in tax-deferred accounts, though. We plan to wait at least until age 66 to take Social Security, and the thought of not having some kind of a regular income gives me the heebie jeebies.

Thanks again!

Dave

I am 62 and my wife is 61. She has been retired for about two years. We elected to take her pension as a lump sum, rolled over into an IRA.

We live in Texas, so no state income tax.

The pensions are well funded, and are protected by PBGC. I guess that means they are fairly secure.

The reserve annuity is indeed a cash refund annuity.

In terms of our financial situation, the total of these two lump sum amounts would just be a small fraction of our retirement assets. Most of our assets are in tax-deferred accounts, though. We plan to wait at least until age 66 to take Social Security, and the thought of not having some kind of a regular income gives me the heebie jeebies.

Thanks again!

Dave

nun

Thinks s/he gets paid by the post

- Joined

- Feb 17, 2006

- Messages

- 4,872

In terms of our financial situation, the total of these two lump sum amounts would just be a small fraction of our retirement assets. Most of our assets are in tax-deferred accounts, though. We plan to wait at least until age 66 to take Social Security, and the thought of not having some kind of a regular income gives me the heebie jeebies.

Thanks again!

Dave

Whether to take the pensions depends on your assets, your need for income and your approach towards risk.

The pensions are better than the quotes on "Immediate Annuities" and given your final comment I would take the pensions. Lots of people find that having a guaranteed check coming in every month makes retirement a lot more fun.

Slow But Steady

Recycles dryer sheets

Thanks again for the comments. I don't have to decide until May, so I will cogitate for a while before deciding.

Big_Hitter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Have you calculated the present value of all of the options?

You may find that the leveling options have the highest present value since they use the lowest interest rate, on a front-loaded basis, to restructure your normal form of payment - which seems to be the life w 5 certain.

I haven't cranked through the numbers but if it were my choice, please do not construe this as legal or financial advice, I'd think hard about one of the J&S leveling options.

You may find that the leveling options have the highest present value since they use the lowest interest rate, on a front-loaded basis, to restructure your normal form of payment - which seems to be the life w 5 certain.

I haven't cranked through the numbers but if it were my choice, please do not construe this as legal or financial advice, I'd think hard about one of the J&S leveling options.

Last edited:

Slow But Steady

Recycles dryer sheets

I'm tying to find out what the leveling time is. The first person I talked to said it was 62. I told her I'm already 62, and she couldn't explain the options. She said she will find out more and call me back.

I'm also lining up a new tax accountant who may have an opinion. (I'm thinking of firing the old tax preparer... myself.)

I'm also lining up a new tax accountant who may have an opinion. (I'm thinking of firing the old tax preparer... myself.)

racy

Full time employment: Posting here.

- Joined

- May 25, 2007

- Messages

- 883

Take the lump sum. "A bird in hand is worth 2 in the bush". My concern is that insurance companies will be able to fulfill their annuity obligations, as breakthroughs in longevity keep coming.

This 110-year-old woman is a whisky-swigging badass | New York Post

This 110-year-old woman is a whisky-swigging badass | New York Post

Similar threads

- Replies

- 8

- Views

- 849

- Replies

- 19

- Views

- 586

- Replies

- 36

- Views

- 3K