nash031

Thinks s/he gets paid by the post

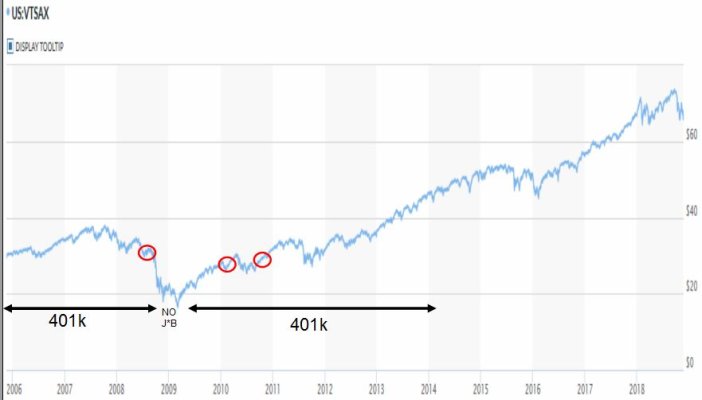

I didn’t have a hard time tuning out the noise at all. I accelerated my savings, and the $60K or so I sank in between 2008/09 has grown almost four fold since. Maintain the long view. Figure out how to ignore noise. There’s always noise. That addition of $60K over six months or so represented about 30% of my portfolio at the time. Nothing goes away until you sell, so I always read the “lost it all” stories with a quizzical eye.Curious to hear some stories/experiences of those of you who stuck to your guns through the scary 2008-2010 period. I was young, low income, and we had little in the market back then....and it was pretty hard to tune out the “sell stocks and buy bullets and gold” noise.

I want to be ready for the next downturn as we have a lot more in the market and both automatically and purposefully buy in regularly.

What was your experience through recessions? Did you buy more? How did it work out for you gains wise? Any regrets?

Last edited: