You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Why am I struggling? - Social Security Question

- Thread starter Retiredmajor

- Start date

daylatedollarshort -

https://am.jpmorgan.com/us/en/asset-management/adv/insights/retirement-insights/guide-to-retirement

Page 4 - Life expectancies in the United States continue to increase as more people are living to older ages. This chart shows the probability that 65-year-old men and women today will reach various ages. For a 65-year-old couple, there is nearly an even chance that one of them will live to age 90 or beyond. Individuals should plan for living well beyond the average – to age 95 or even 100 – especially those in good health and with a family history of longevity.

Page 8 - Social Security timing tradeoffs Delaying benefits results in a much higher benefit amount: Waiting to age 70 results in 32% more in a benefit check than taking benefits at FRA. Likewise, taking benefits early will lower the benefit amount.

Page 9 - Claiming Social Security - decision tree Working, having other sources of income, expected longevity, preserving a portfolio and trying to maximize benefits are important considerations. The possibility of benefits for family is not included

Page 10 - Maximizing Social Security benefits-maximum earner The breakeven age between taking benefits at age 62 and FRA is age 77 and between FRA and 70 is 81. Along the bottom of the page, the percentages show the probability that a man, woman or one member of a married couple currently age 62 will live to the specified ages or beyond. Comparing these percentages against the breakeven ages will help a beneficiary make an informed decision about when to claim Social Security if maximizing the cumulative benefit received is a primary goal.

Page 11 - Generally, the longer the life expectancy and the lower the expected return, the more it pays to wait to claim the benefit. For example, for a consistent return of 5% or less after fees, and expected longevity of age 86 or later, consider waiting to age 70 to claim if that is financially possible.

https://am.jpmorgan.com/us/en/asset-management/adv/insights/retirement-insights/guide-to-retirement

Page 4 - Life expectancies in the United States continue to increase as more people are living to older ages. This chart shows the probability that 65-year-old men and women today will reach various ages. For a 65-year-old couple, there is nearly an even chance that one of them will live to age 90 or beyond. Individuals should plan for living well beyond the average – to age 95 or even 100 – especially those in good health and with a family history of longevity.

Page 8 - Social Security timing tradeoffs Delaying benefits results in a much higher benefit amount: Waiting to age 70 results in 32% more in a benefit check than taking benefits at FRA. Likewise, taking benefits early will lower the benefit amount.

Page 9 - Claiming Social Security - decision tree Working, having other sources of income, expected longevity, preserving a portfolio and trying to maximize benefits are important considerations. The possibility of benefits for family is not included

Page 10 - Maximizing Social Security benefits-maximum earner The breakeven age between taking benefits at age 62 and FRA is age 77 and between FRA and 70 is 81. Along the bottom of the page, the percentages show the probability that a man, woman or one member of a married couple currently age 62 will live to the specified ages or beyond. Comparing these percentages against the breakeven ages will help a beneficiary make an informed decision about when to claim Social Security if maximizing the cumulative benefit received is a primary goal.

Page 11 - Generally, the longer the life expectancy and the lower the expected return, the more it pays to wait to claim the benefit. For example, for a consistent return of 5% or less after fees, and expected longevity of age 86 or later, consider waiting to age 70 to claim if that is financially possible.

CRLLS

Thinks s/he gets paid by the post

Just curious if you have a link to those studies? What life expectancy are you using for a 60 year old? What odds are there of one or both of a couple living to 90?

The odds of one living into their 90's are better than even. Here is a actuarial table for annuities based on age and gender.

"The Annuity 2000 mortality table was adopted by the

National Association of Insurance Commissioners in 1996 as an appropriate table for valuing annuity interests."

https://www.pgcalc.com/pdf/twolife.pdf

It says that for a couple both aged at 60 years, there is a 50/50 chance that one or the other will attain the age of 91.8 years. If they are both 70, the age goes to 92.6

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

.... And lastly, studies have shown that based on the life expectancy of someone who makes it to age 60, you will get more SS benefit over your lifetime if you wait until age 70 to file. And chances are that for married couples, at least one spouse wil live into their 90's.

Just curious if you have a link to those studies? What life expectancy are you using for a 60 year old? What odds are there of one or both of a couple living to 90?

That is true. Check out the SOA/AAA longevity calculator at https://www.longevityillustrator.org/

DW and I are 65/66. There is a 68% chance that one or the other of us will live to 90 and a 39% that one or the other of us will live to 95.

| Years | pb4uski | Ms.pb4uski | Either | Both |

| 0 | 100% | 100% | 100% | 100% |

| 5 | 95% | 97% | 99% | 92% |

| 10 | 87% | 91% | 99% | 80% |

| 15 | 76% | 82% | 96% | 62% |

| 20 | 59% | 68% | 87% | 40% |

| 25 | 38% | 48% | 68% | 18% |

| 30 | 18% | 26% | 39% | 5% |

| 35 | 6% | 10% | 15% | 1% |

| 40 | 1% | 3% | 4% | 1% |

| 45 | 1% | 1% | 1% | 1% |

| 50 | 0% | 0% | 0% | 0% |

Out of Steam

Thinks s/he gets paid by the post

- Joined

- Mar 14, 2017

- Messages

- 1,666

In a married couple, you get either your own social security or the spousal benefit (1/2 of other spouse), whichever is larger. So, assuming you could do what you propose, her own SS would go up from $400 to $940 due to elimination of the WEP. Her spousal benefit is not currently completely wiped out by the GPO. Rather, it is reduced by 2/3 of the non-covered pension amount. So, right now, she could collect a spousal benefit of (1/2 x 2900) - (2/3 x 1000) = 784. And she probably should, since it is more than her WEP-reduced social security. If she could escape the GPO, the spousal benefit would be $1450 (1/2 of yours), which is larger than her own, so she would take that. So, assuming she switches from her own SS (400) to spousal (784), her current income is spousal SS + teacher pension = 784 + 1000 = 1784. Assuming she could disclaim her teacher pension, her income would be just full spousal SS = $1450, because she would be giving up her teacher pension. So she would be losing $334 per month, net.

Now let's look at survivor benefits, which are your full amount or her own SS, whichever is greater. As things stand now, her own SS is $400, but would be $940 if disclaiming her pension could avoid the WEP. If you died tomorrow, her GPO reduced survivor benefit would be your benefit minus 2/3 of her teacher pension = 2900 - 667 = $2233 per month. So she would obviously take her survivor benefit and give up her own SS, WEP or no WEP. Then her income as a widow would be the $2233 GPO reduced survivor benefit plus $1000 teacher pension or $3233/mo. If, as you propose, she had disclaimed her pension to avoid the GPO, she would get full survivor benefit of $2900 but would not have her $1000 teacher pension. So she would lose $323/mo., net.

Thanks, Gumby. This discussion has helped me understand an element of open Social Security estimates that I have run, specifically that we do not gain NPV by postponing my wife’s SS beyond 64-65. It appears to be because as a Federal Retiree with a CSRS pension element, I can’t receive an increased benefit as a survivor over my own earned benefit.

My ability to draw from SS is still a number of years away, but for me the longer I wait the more my wife will get should I pass before she does. A calculator I used showed it's beneficial to have her draw at 62, keeping our assets earning. Me waiting until 70. With life expectancy for her to be more than me she draws my benefit, which is significantly higher than hers, after my passing. Each case is different, but something to consider.

+1

I started the DW at 62 for the same reason. However I started at FRA + 2 months (Jan) to lessen the withdrawals a bit. Started in Jan because I had the taxes figured and did not want the 2 months SS to mess with those numbers.

Old Microbiologist

Recycles dryer sheets

W didn't need it so took it early. You never know how long you are going to live and the US government periodically makes a lot of noise about taking it away (both parties). I learned in the military that if the government offers something take it fast because they definitely will take it away again later. Serving in the military for 40 years (active and civilian) teaches you vast cynicism.

That said I had several friends that put off taking it and died shortly after or before they started. The actuarial actually depend on that in their calculations. Also, the COLA never matches real inflation. I have my military pension and retirees get half (or less) the COLA active-duty soldiers get. SSA and military retiree COLAS are always the same but basically half what of what would be correct. I am curious to see how they game this year's inflation numbers to cheat us again. The government can't afford to pay us and it is going to sting later. I foresee from the debacle in Afghanistan a coming impetus to cut government spending (beginning with the military) which is what happened after the Vietnam debacle. Yo me ti is a good thing and given our debt is predicted to hit $45 trillion by January it is necessary. SSA will very likely be affected and possibly some means testing put in place so that those of us who planned ahead and have enough to retire with will take a hit in SSA.

That said I had several friends that put off taking it and died shortly after or before they started. The actuarial actually depend on that in their calculations. Also, the COLA never matches real inflation. I have my military pension and retirees get half (or less) the COLA active-duty soldiers get. SSA and military retiree COLAS are always the same but basically half what of what would be correct. I am curious to see how they game this year's inflation numbers to cheat us again. The government can't afford to pay us and it is going to sting later. I foresee from the debacle in Afghanistan a coming impetus to cut government spending (beginning with the military) which is what happened after the Vietnam debacle. Yo me ti is a good thing and given our debt is predicted to hit $45 trillion by January it is necessary. SSA will very likely be affected and possibly some means testing put in place so that those of us who planned ahead and have enough to retire with will take a hit in SSA.

I don't think this is 100% true. You are correct that her spousal amount will never be more than 50% of your full PIA. But if you wait until 70 to claim and then predecease her, she will get bumped up to your full amount as survivor.

You're correct on that point upon my passing ... My point is the common mode of thinking by most prognosticators is wait till 70 and get the ~8% bump each year. I will get that bump till age 70, my wife's bump stops at my FRA.

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

SSA will very likely be affected and possibly some means testing put in place so that those of us who planned ahead and have enough to retire with will take a hit in SSA.

+1. I feel like any "when to take SS article" that doesn't even at least mention the issue of the trust fund running out of money in 2035 is not a comprehensive analysis. The trust fund issue is not a factor to take lightly. Means testing has been brought up in the news many times as one possible way to cover the future shortfall. That could impact many on this forum who have significant amounts of retirement income besides SS.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Same idea. The ~8% yearly increase for my spouse (since she didn't work outside the home) stops at my FRA (66y4m for me). So 66-4 is it for me!

I don't think this is 100% true. You are correct that her spousal amount will never be more than 50% of your full PIA. But if you wait until 70 to claim and then predecease her, she will get bumped up to your full amount as survivor.

You're correct on that point upon my passing ... My point is the common mode of thinking by most prognosticators is wait till 70 and get the ~8% bump each year. I will get that bump till age 70, my wife's bump stops at my FRA.

I think Broland's premise is flawed. We are in the same situation... similar age and DW was a SAHM and her benefit based onher work record is ~30% of mine.... but opensocialsecurity.com suggest that I delay benefits.

It is more likely than not that one ot the other of us will live until our 90s and collect that extra 8% a year.

IOW, the extra 8% a year offsets DW only collecting 30% vs 50% for 4 years (from FRA to 70).

+1. I feel like any "when to take SS article" that doesn't even at least mention the issue of the trust fund running out of money in 2035 is not a comprehensive analysis. The trust fund issue is not a factor to take lightly. Means testing has been brought up in the news many times as one possible way to cover the future shortfall. That could impact many on this forum who have significant amounts of retirement income besides SS.

My understanding is the trust fund will not run out of money then, but will need to reduce payouts, unless legislation changes. Many believe elected officials will not allow this to happen, at least to the full degree. Prudent planners plan for the reduction to happen then, as a worse case scenario.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

camfused is right... it won't "run out of money" but rather will have less money.... around 2034 if no other changes are made, benefits will bhaircut by ~25%... so ~75% of expected benefits.

Given the political sh!tstorm that will happen if that happens, I predict that the Congresscritters will make changes to prevent that from happening.

Given the political sh!tstorm that will happen if that happens, I predict that the Congresscritters will make changes to prevent that from happening.

LRDave

Thinks s/he gets paid by the post

That said I had several friends that put off taking it and died shortly after or before they started.

As a counterpoint, my 97 YO father started at 62 and had literally lived to regret it. He is not one to give financial advice but reminds his 3 adult children of the error he made whenever the topic comes up.

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

My understanding is the trust fund will not run out of money then, but will need to reduce payouts, unless legislation changes. Many believe elected officials will not allow this to happen, at least to the full degree. Prudent planners plan for the reduction to happen then, as a worse case scenario.

I knew someone would say that, which is why I included the link to the SS site in my reply. The SS trust fund is not the same thing as SS as an entity - "The OASI Trust Fund alone can pay full benefits until 2034".

You can do what you want with that information, but SS has been changed in many ways over the years, and to ignore that possibility for happening in the future doesn't seem logical to me.

Last edited:

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The salvation of SS for us is the fact that old folks vote and people think in the moment. So the logical course will be for the congresscritters to leave current benefits largely or totally untouched and to raise money by pushing out the FRA for people who are not really close to it and to remove the ceiling on the payroll tax. I'm not worried.I knew someone would say that, which is why I included the link to the SS site in my reply. The SS trust fund is not the same thing as SS as an entity - "The OASI Trust Fund alone can pay full benefits until 2034".

As a practical matter, there is no SS trust fund. Theoretically it is "invested" in US government securities. The government's "paying back" the SS investment just means borrowing from someone else. So it's just a sort of shell game where there really is no bean. But that's ok. The politic pressures will bail us out.

USGrant1962

Thinks s/he gets paid by the post

+1. I feel like any "when to take SS article" that doesn't even at least mention the issue of the trust fund running out of money in 2035 is not a comprehensive analysis. The trust fund issue is not a factor to take lightly. Means testing has been brought up in the news many times as one possible way to cover the future shortfall. That could impact many on this forum who have significant amounts of retirement income besides SS.

And FWIW, the Administration is sitting on the 2021 Social Security/Medicare Trustees Report. It was due April 1 and is now the latest it has ever been. It will likely show further deterioration in trust fund forecasts.

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I volunteer as an admin for a Facebook group called "Social Security Intelligence" and we answer SS questions literally every day.

Sign up for Medicare Part A about 3 months before you turn 65. If you are covered by company provided health insurance, you can delay signing up for Part B. Or you may be able to negotiate a raise or something if you choose to go off the company health insurance and totally on Medicare. You may also need supplemental Medicare policies. In addition to Part D (drugs), since there is no cap to the Medicare co-pay, a policy that will kick in to pay the co-pay after a certain amount might be a good idea. I have "Tricare for Life" so I do not need the supplemental policies but if I did, I would give the company "Boomer Benefits" a call. they only deal with Medicare supplemental policies. They also have a fb page called "Medicare Q & A" to answer Medicare questions.

Now about SS. There are several factors to decide when to file. The biggest factors is how much you have saved for retirement, if you are still working, and if you are married and your spouse has a lower SS benefit. (and yes, you will get that COLA - your estimated benefit will be larger).

You need to not only look at the SS benefit for the rest of your life but also that of your spouse if their earned benefit is smaller. Most likely your spouse will outlive you and a larger SS benefit will provide more fixed income that may be needed in later years. The general rule of thumb is for the lower earning spouse to file for SS early (for income) and the higher earner to wait until age 70 to file, if possible. this ensures no matter which spouse dies first, the surviving spouse has the highest amount of benefit possible. This recommendation to wait until 70 has other factors like what any spousal benefit would be (can only get this after the spouse has filed), health, and other assets

If you choose to start SS at age 65, your benefit will be reduced for life. in addition, you will have an income ceiling - if you exceed that ceiling, your SS benefit will be reduced further. Plus, most likely 85% of that SS will also be subject to income tax.

Some people choose to delay filing for SS so their benefit will grow larger. (I consider it to be an "annuity-like asset" with a guaranteed payout as long as I am alive - and spousal benefit too). They use this time until then to draw down assets in a pre-tax retirement accounts. This reduced the possibility of a tax increase and possible Medicare premium increases later on, especially when RMDs start and after one spouse dies (the "step" for the Medicare surcharge is cut in half).

Yes, you may be "attached" to that money in the retirement account because you have saved so long for it. But it can be a "tax bomb" if that balance is not drawn down soon enough and it is the worst thing for a non-spouse heir to inherit because there is no tax advantage and may even make the family ineligible for things like college grants and scholarships or certain programs if disabled.

And lastly, studies have shown that based on the life expectancy of someone who makes it to age 60, you will get more SS benefit over your lifetime if you wait until age 70 to file. And chances are that for married couples, at least one spouse wil live into their 90's.

This is (was at time of SS at 70 for me) what I understood. To me, the main thing is spousal survival advantage of waiting until age 70 (if you don't need the money earlier to survive). That can be a very good benefit for your spouse. YMMV

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

The salvation of SS for us is the fact that old folks vote and people think in the moment. So the logical course will be for the congresscritters to leave current benefits largely or totally untouched and to raise money by pushing out the FRA for people who are not really close to it and to remove the ceiling on the payroll tax. I'm not worried.

As a practical matter, there is no SS trust fund. Theoretically it is "invested" in US government securities. The government's "paying back" the SS investment just means borrowing from someone else. So it's just a sort of shell game where there really is no bean. But that's ok. The politics will bail us out.

Old folks have always voted and there have been many subtle cuts to SS over the years.

The SS Board of Trustees seems to be under the impression there is a trust fund - "As a result of changes to Social Security enacted in 1983, benefits are now expected to be payable in full on a timely basis until 2037, when the trust fund reserves are projected to become exhausted."https://www.ssa.gov/policy/docs/ssb/v70n3/v70n3p111.html

So does the NY Times - "Unless a political solution is reached, Social Security’s so-called trust funds are expected to be depleted within about 15 years. Then, something that has been unimaginable for decades would be required under current law: Benefit checks for retirees would be cut by about 20 percent across the board." https://www.nytimes.com/2019/06/12/business/social-security-shortfall-2020.html

Also from the article, "Democrats in Congress have suggested an increase in Social Security benefits, accompanied by higher taxes for the wealthy. ...Conservatives continue to push for sharp reductions in the size of Social Security as well as Medicare, saying the United States can’t afford the growing burden of the two “entitlement programs.”

"The Social Security mess already complicates some commonly accepted retirement-planning wisdom — such as the advice to delay claiming benefits until age 70....People who do so are entitled to an 8 percent annual increase in benefits. That makes Social Security “the best annuity that money could buy,” said Wade Pfau, a professor of retirement income at the American College of Financial Services, in a 2015 report. But he redid his calculations at the request of The Times, and for workers who are 55 now, statutory benefit cuts just when they turn 70 could make that approach far less attractive, Professor Pfau said."

Future benefits cuts aren't just a remote possibility, they are the current projected future status.

Last edited:

I'm soon to be 65 and will sign up for Medicare next month. I'm deciding when to take Social Security. I will either do it when I sign up for Medicare or wait until my FRA of 66 and 4 months.

EVERY retirement calculator I use (Firecalc + 3 others) and our Financial Advisor tell me that either way, we are financially fine and, at some point, are splitting hairs. A simple spread sheet tells me that the difference between taking SS at 65 versus 66 is $38,000 over 30 years. I'll be honest, I like the idea of drawing less from our Nest egg each year and taking SS earlier accomplishes that.

Plus, I'm hearing that SS may get a fairly large COLA increase in 2022 in the vicinity of 5 to 6%. Of course that makes all my numbers look better, but also makes me feel better about taking SS at age 65.

Why am I struggling with this? It seems that I'm letting it become an emotional issue when it's just math!

All advice is welcome! Major

Your initial post has the answer. Read it. It is quite obvious what your preference is.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The salvation of SS for us is the fact that old folks vote and people think in the moment. So the logical course will be for the congresscritters to leave current benefits largely or totally untouched and to raise money by pushing out the FRA for people who are not really close to it and to remove the ceiling on the payroll tax. I'm not worried.

As a practical matter, there is no SS trust fund. Theoretically it is "invested" in US government securities. The government's "paying back" the SS investment just means borrowing from someone else. So it's just a sort of shell game where there really is no bean. But that's ok. The politic pressures will bail us out.

On the first part, I agree with you... it is unlikely that congresscritters would significantly reduce benefits for those currently receiving benfits or those close to age 62... they didn't do that with the revisions made in the 1980s... besides, those people vote in large numbers.

On the second part, there definitely is an SS trust fund... in fact, there are several... it isn't a separate entity like a typical trust which is probably why OldShooter says that there isn't one "as a practical matter"... but he is just wrong on that... it operates just like a typical trust would....it is a segragated fund accounting in the federal government's books of account. Many public entities have separate fund accounting and the SS Trust Fund is even more segregated that typical government entity funds... it's ring-fenced with constraints on what can be added to the fund (certain tax revenues only) and more importantly, what the fund can be spent on (statutory benefits only but only to the extent that money is available).

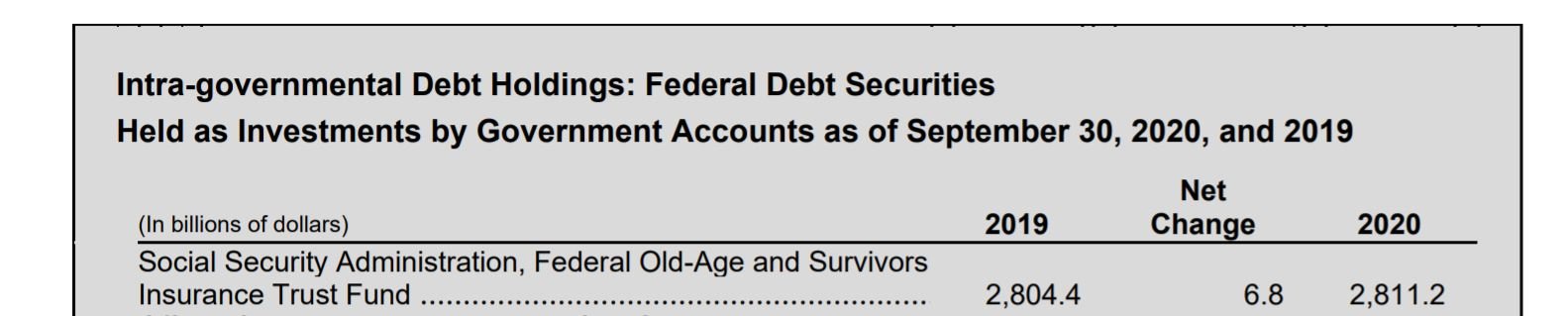

... In addition to debt held by the public, the government has about $6.0 trillion in intra-governmental debt outstanding, which arises when one part of the government borrows from another. It represents debt issued by Treasury and held by government accounts, including the Social Security ($2.9 trillion) and Medicare ($221.2 billion) trust funds. Intragovernmental debt is primarily held in government trust funds in the form of special nonmarketable securities by various parts of the government. Laws establishing government trust funds generally require excess trust fund receipts (including interest earnings) over disbursements to be invested in these special securities. Because these amounts are both liabilities of Treasury and assets of the government trust funds, they are eliminated as part of the consolidation process for the government-wide financial statements (see Note 12). When those securities are redeemed, e.g., to pay Social Security benefits, the government must obtain the resources necessary to reimburse the trust funds.

Source: https://fiscal.treasury.gov/files/reports-statements/financial-report/2020/fr-03-25-2021-(final).pdf page 27

And on page 105:

Attachments

Last edited:

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I agree in an accounting sense, but I don't think that fund going to zero matters in a practical sense. As things now stand, that liability of the federal government (and the corresponding asset on SS BS) is slowly going to zero as the government borrows from other lenders and passes the money to SS. But from the point where it goes to zero nothing really changes. The government will continue to borrow from other lenders and pass the money to SS. (bookkeeping entries tbd) At some point the law will be changed to reduce the bleeding but that timing is fairly irrelevant to the "trust fund" status.... there definitely is an SS trust fund ...

mickeyd

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

If you can afford to delay SS until age 70 (and are healthy) consider doing so. No one here can make that decision for you.

USGrant1962

Thinks s/he gets paid by the post

I agree in an accounting sense, but I don't think that fund going to zero matters in a practical sense. As things now stand, that liability of the federal government (and the corresponding asset on SS BS) is slowly going to zero as the government borrows from other lenders and passes the money to SS. But from the point where it goes to zero nothing really changes. The government will continue to borrow from other lenders and pass the money to SS. (bookkeeping entries tbd) At some point the law will be changed to reduce the bleeding but that timing is fairly irrelevant to the "trust fund" status.

This is not true under current law. The SSA can only spend SS funds, not general funds. The trust funds are prior excess SS/Medicare taxes collected and "invested" in special treasury securities - they actually earn interest which is credited to the fund. The trust fund is just as real as the 10-year Treasuries in your portfolio. When the trust fund runs out, SSA can only pay out what it collects in current SS taxes - about 75% of obligations.

Again, this is all under current law. That doesn't mean Congress can't change the law and they will clearly need to do something, sometime.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I agree in an accounting sense, but I don't think that fund going to zero matters in a practical sense. As things now stand, that liability of the federal government (and the corresponding asset on SS BS) is slowly going to zero as the government borrows from other lenders and passes the money to SS. But from the point where it goes to zero nothing really changes. The government will continue to borrow from other lenders and pass the money to SS. (bookkeeping entries tbd) At some point the law will be changed to reduce the bleeding but that timing is fairly irrelevant to the "trust fund" status.

No, it doesn't work that way. Once the SS trust fund surplus is zero (the general fund has repaid all that it borrowed plus interest), the general fund cannot borrow from the public and pass money on to SS for benefit payments as you think... that is why there is a ~25% haircut projected for 2034... the surplus will be depleted and the trust can only pay benefits equal to the taxes that they are taking in.... the trust does not have the authority to borrow money.

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

Without legislation changes, the probability of SS getting a 20% decrease in 2035 is basically 100%. It is what will happen under current law. What is the probability of legislation to change the current law? Likely pretty good, but I wouldn't assign a 100% probability factor to a future event that is likely but hasn't happened yet. Then add to that less than 100% chance of legislation changes, what are the chances legislation changes will involve benefit cuts (possibly in a subtle way, like chained CPI, but cuts nonetheless), means testing or tax increases for well off retirees? I'd peg those odds as actually pretty good, maybe more than 50%. One or a combination of those are in many of the proposals being floated as SS legislation fixes.

Last edited:

Similar threads

- Replies

- 55

- Views

- 5K

- Replies

- 15

- Views

- 746

- Replies

- 3

- Views

- 328