FANOFJESUS

Thinks s/he gets paid by the post

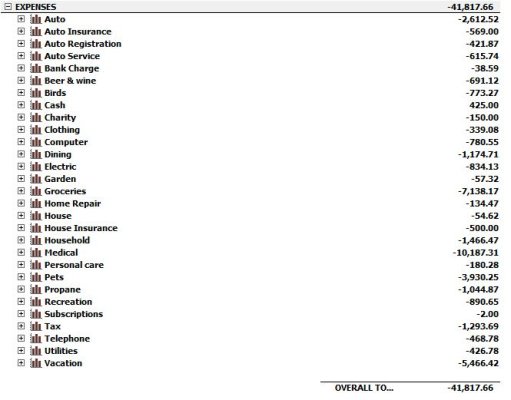

I keep reading threads where people can live on $30 - $50k per year. My budget is $84k and I think its pretty bare bones.

Home is fully paid - 1600 sq ft. No car payments (cars are 3 and 10 years old). Boat is a 16 ft jon boat - nothing fancy. Dog expenses are high - even tho she's only 6 yo she has some health challenges.

"Future one time purchases" budget includes big ticket items - car replacements, applicance replacements. Ongoing purchases includes replacements of smaller items (televisions, small appliances) and purchase of new things (towels, books, etc).

I could probably take 10k out of this budget (dog 2k, vacation 3k, boat 1k, cellphones 1k, entertainment 1k, pocket money 2k) but thats all I see.

What am I doing wrong ?

We live on about 16k. Our house is a little bit smaller than yours. Ours budget looks like this in the Midwest.

Taxes/insurance 275

health insurance 105

utilities 250

eating at home 400

eating out 200

running an old car 150

I looked at your budget it looks like death by a thousand cuts as some call it. A lot of small holes can sink a large ship. I would look very careful at all your small bills. We live on less than your health insurance. You might try to shop around more on that one. It also depends were you live I think all posters should tell what state they live in it would help at budget time.

Last edited: