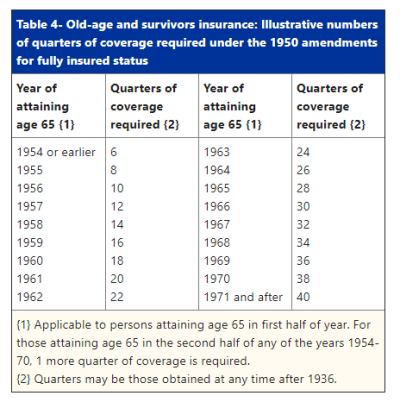

I understand that one needs 40 "credits" to qualify for claiming Social Security benefits on your own record.

Anyone familiar enough with the history of Social Security to know why it was set to only 40? What is the thinking behind that number?

Has anyone proposed that the government raise the number of credits/quarters required? I know it wouldn't be a popular Early Requirement change, but I guess I'm surprised that I haven't heard it proposed elsewhere.

Anyone familiar enough with the history of Social Security to know why it was set to only 40? What is the thinking behind that number?

Has anyone proposed that the government raise the number of credits/quarters required? I know it wouldn't be a popular Early Requirement change, but I guess I'm surprised that I haven't heard it proposed elsewhere.