You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Will stimulus lead to inflation? Shiller responds.

- Thread starter twaddle

- Start date

Out-to-Lunch

Thinks s/he gets paid by the post

Key word there being "average".

Here, it's already up 25+% (I know - I pay the bill for it). Other places in the country are up even more than 25%.

Soo, you are thinking that the "stability of our entire monetary system" (your words) is, uhhh, regional?

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

10% in NJ. I could not find a single place up 25% YTD.Key word there being "average".

Here, it's already up 25+% (I know - I pay the bill for it). Other places in the country are up even more than 25%.

DrRoy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My short version, from Econ 101, is that inflation requires "too much money chasing too few goods".

Sure looks to me like assets are inflating. Housing and equities.

Perhaps the increased money supply has mostly gone into investible assets instead of purchasable goods more broadly.

Who do you think is the main entity backstopping the Federal deficits?It's such a complicated picture, really. We're mixing monetary policy with a fiscal stimulus, for one.

Bottom-line: I have no idea how this will play out, so I have to revert to my old stand-by of "minimize regret." (I don't regret missing out on the bitcoin boom, but maybe someday I will.)

Update from my friend. Turns out he already made a move and liquidated a lot of his real estate. So he's mostly concerned about sitting on a pile of cash and being afraid to deploy it, I guess. I'll suggest bitcoin.

bolt

Recycles dryer sheets

- Joined

- Jun 14, 2008

- Messages

- 424

Adam Ferguson's : "When Money Dies" book is applicable in its historical depictions.

I recently started reading it.

I also believe above normal inflation is on the horizon.

Adding 2Trillion(1.9T currently proposed in USA)to the money supply is inflationary & foolhardy. jmho

Good luck & Best wishes......

I recently started reading it.

I also believe above normal inflation is on the horizon.

Adding 2Trillion(1.9T currently proposed in USA)to the money supply is inflationary & foolhardy. jmho

Good luck & Best wishes......

Last edited:

24601NoMore

Thinks s/he gets paid by the post

- Joined

- Dec 8, 2015

- Messages

- 1,166

Soo, you are thinking that the "stability of our entire monetary system" (your words) is, uhhh, regional?

Give me a break. That's not what I said, AT ALL.

My concerns on the stability of the US monetary system have everything to do with the Fed pumping trillions of dollars that we DO NOT HAVE and need to borrow, into the system. That's not a "regional" problem. It's a national problem.

The US is dead broke. Yet, today's politicians on both sides seem to think we can just keep issuing these multi-trillion dollar (largely boondoggle) "stimulus" bills that add HUGELY to our already unsustainable debt burden. Note that this is fairly new over the last year, after the start of COVID. We've always had large deficit spending. But it's the staggering size of the latest deficit spending that is going to inevitably lead to likely high inflation and perhaps ultimately, collapse.

Multi-trillion dollar lump spending (over and over again) simply can't last. There's only so much you can do to tax "the rich" - even at 100% total income and wealth confiscation, we just do not and would not have the money to keep putting out multi-trillion dollar programs. And if the 1.9T stimulus wasn't damaging enough..there's talk of a multi-trillion (I think I've heard $2-3T) "infrastructure" bill right behind this. Inflation? Heck, yeah. Perhaps runaway inflation.

Equally concerning - when we don't have the money to pay for programs like SS & Medicare, that's going to crush those of us in retirement. Reaching for (yet more) tax increases won't solve the problem - the debt is simply too high, and there's not enough wealthy people or corporations to increase taxes on to get enough $$ to pay for everything. So, taxes will likely HAVE to go up on ALL of us - perhaps significantly. And even then, there won't be enough $$ to pay for everything including the interest on all that new national debt.

Eventually, the whole thing has to go belly up. We simply can't keep spending at the levels that we are spending at and expect our financial system to survive long (or even near) term.

To that point - the US debt as a multiple of GDP is currently higher than that same ratio for Greece, right before Greece collapsed. Think about that. And that's BEFORE the $1.9T next stimulus and the $2-3T infrastructure bill that's almost certain to come next.

(And as you can see, this has absolutely nothing to do with the price of gas on a regional basis..)

24601NoMore

Thinks s/he gets paid by the post

- Joined

- Dec 8, 2015

- Messages

- 1,166

10% in NJ. I could not find a single place up 25% YTD.

Gas here, start of year: ~$2/gal.

Gas yesterday when filling up wife's car..$2.57/gal.

$2.57 / $2 = 28.5% increase since start of year.

PussInBoots

Dryer sheet wannabe

- Joined

- Feb 8, 2021

- Messages

- 19

High inflation is how we fixed our national debt after WW2. Yup it is coming.

Hmm I wonder what will happen to cash, CDs and Bonds.

Hmm I wonder what will happen to cash, CDs and Bonds.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

High inflation is how we fixed our national debt after WW2. Yup it is coming.

Hmm I wonder what will happen to cash, CDs and Bonds.

Stocks would be hit very hard too. There is no escape!

jkern

Full time employment: Posting here.

My short version, from Econ 101, is that inflation requires "too much money chasing too few goods". While there is a lot of money sloshing around, there is no shortage of goods. Or of labor thanks to Covid (we were approaching labor shortages a year ago and real wages were rising). And we haven't had real shortages of anything important for a long time. Hence little to no inflation.

Tell that to my insurance company that just raised my rental home premiums by 55%.

PussInBoots

Dryer sheet wannabe

- Joined

- Feb 8, 2021

- Messages

- 19

Stocks would be hit very hard too. There is no escape!

When you walk to store and see higher prices you see how stocks deal with it.

Stocks may suffer but will recover. There is no recovery for cash, CDs, Bonds.

Markola

Thinks s/he gets paid by the post

Interest rates are not "imbedded" with inflation. Interest rates are determined by market supply and demand. When governments decidethey can buy as many bonds as necessary in order to keep the interest rates lower, then the market is not functioning as an indicator of value. So what is the common man supposed to do? In great flocks they are buying bit coin and stocks, the biggest country supporting Bitcoin is China where 65% of all bitcoins are produced. It was not coincidental that TESLA purchased 1.3 billion dollars of bitcoin and is counting on the Chinese market for it's sales.

I think it is simplistic to not contemplate why one of the largest market cap companies in the world issues 2 billion in stock and uses one point three billion of that to buy bitcoin and since has doubled the value of the bitcoin held, that something is going on other than retirees reduced consumption. Bonds are becoming openly viable to mock as an investment by any company, since they hold no interest rate they are actually functioning as cash holdings, something to be held for short term until a risk asset can be purchased.

Another interesting fact, if you try to buy a silver eagle in hard form you will pay $35 per ounce for the metal itself at wholesale, even though paper sliver is going for $27. So silver does not have that much inflation over the past year unless you are someone who actually needs the silver.

The CRB index is about to break a 12 year trend line from the decline in 2008 and has risen nearly 100% since "stimulus" payments gave hold.

Here are the current YTD price increases in some commodities:

Crude Oil USD/Bbl 25.99%

Natural gas USD/MMBtu14.34%

Gasoline 28.84%

Propane USD/Gal 41.86%

18,000 tons of copper 18.26%

Lumber: 15.42%

Cotton: 15.54%

Sugar: 17.17%

Lithium: 45.1%

Tin: 31.41%

Cobalt: 55%

Corn: 12.76%

Rice: 4.94%

Hog Prices: 20.42%

CRB Index: 12.4%

US Houses Year over Year 10.97

The idea that a 30 year bond trading at 2% is an indication that inflation is under control is an economic self fulfilling forecast of economists who view controlling the interest rates as equivalent to controlling "inflation" and allowing for economic activity to maintain as "debt"

Thanks for the good list. Reading through it, it seems out of context without showing where these prices were pre-Covid. Maybe 1/1//20 would be a better starting point than 1/1/21. Second, there are contributing or even dominant factors for most of them, which are unique to this moment, namely trade wars, weather and early signs of the 6% GDP growth that respected economists, including Goldman Sachs’, are predicting for 2021 as we rebound from 2020.

A lot of the agriculture products above, including lumber, are subject to our lingering trade wars. For example, one of the reasons we’re paying more for lumber is because our imports from Canada have been subject to tariffs.

https://nahbnow.com/2020/12/commerce-department-cuts-lumber-tariffs-from-20-to-9/

1) These tariffs have also contributed, along with 2) record, fantastically low interest rates for mortgages and refinances, together with 3) explosive Covid-driven demand to larger or new houses in the work-from-home era, to the run up in housing costs on your list.

How much of the energy cost increases are due to Texas energy production recently freezing up, which was apparently avoidable and due to poor weather planning on the part of Texas energy producers and regulators?

And how much of the energy and commodity price increases above are due to the economy simply coming back to life after a unique plunge in 2020?

That lithium prices are way up in the context of EV expansion, with GM announcing it will phase to EVs, should surprise no one.

I suspect there’s a lot more going on than the Fed and Congress’ actions to do their jobs and respond to a genuine crisis with many tax paying, voting citizens in dire need. YMMV but I’m taking the long view that the inflationary and deflationary factors unique to our times will sort themselves out, and am staying put.

Last edited:

twaddle

Thinks s/he gets paid by the post

- Joined

- Jun 16, 2006

- Messages

- 1,703

Who do you think is the main entity backstopping the Federal deficits?

Treasury and ultimately the tax-payer. Not sure I see the relevance of your question.

My point was that the monetary policy has been going on for a while (13 years now?). So the recent move in bitcoin was driven by what exactly? Recent fiscal policy?

Last edited:

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

2.652 todayGas here, start of year: ~$2/gal.

Gas yesterday when filling up wife's car..$2.57/gal.

$2.57 / $2 = 28.5% increase since start of year.

2.470 1 year ago

7.4% increase

Avg US prices per gallon.

Sourced from:

New Jersey Gas Prices - Find Cheap Gas Prices in New Jersey

twaddle

Thinks s/he gets paid by the post

- Joined

- Jun 16, 2006

- Messages

- 1,703

I've seen lots of arguments that most of the inflation we've experiences has been absorbed by real estate, equities, bitcoin, gold,

Yeah, none of which are reflected in CPI, GDP, or interest rates (well real estate is indirectly in CPI via rent).

Investment is the reason for this monetary policy, so I guess it's working, but this is not very productive investment.

24601NoMore

Thinks s/he gets paid by the post

- Joined

- Dec 8, 2015

- Messages

- 1,166

2.652 today

2.470 1 year ago

7.4% increase

Avg US prices per gallon.

Sourced from:

New Jersey Gas Prices - Find Cheap Gas Prices in New Jersey

I wouldn't look to "Gas Buddy" as a definitive source, as that's retail vs wholesale - and as we all know, retail is going to vary wildly due to big differences in state & local taxes and other reasons. Let's try actual market commodity prices for wholesale gasoline, nationally that clearly show a >31% YTD increase..see:

https://tradingeconomics.com/commodity/gasoline

I really see no point in going back and forth further on this and candidly can't fathom what point you're trying to make, as it's not supported by publicly available data. I've posted about my own experience from the upper Midwest, and retail gas is up more than 28% YTD here.

Similar data was posted up-thread by Running_Man..I assume his post was from a couple days ago, which would explain the ~2.5% delta from the numbers I posted above.

Here are the current YTD price increases in some commodities:

Crude Oil USD/Bbl 25.99%

Natural gas USD/MMBtu 14.34%

Gasoline 28.84%

Propane USD/Gal 41.86%

...

US Houses Year over Year 10.97

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

twaddle

Thinks s/he gets paid by the post

- Joined

- Jun 16, 2006

- Messages

- 1,703

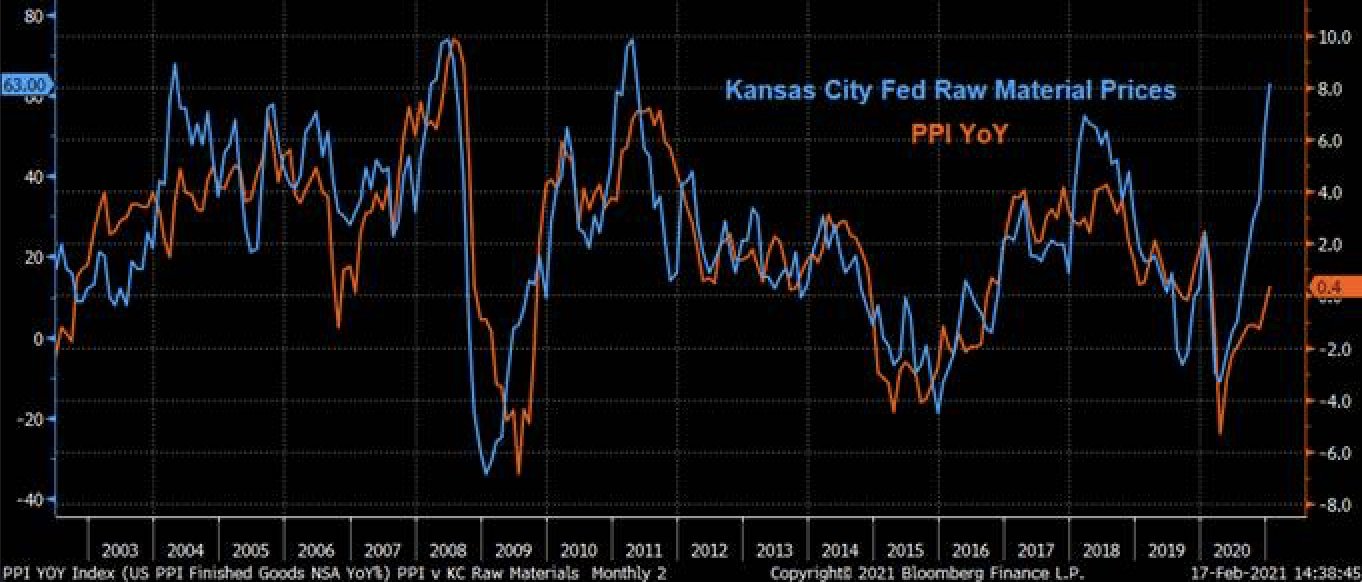

I see cycles in that chart. And a current price that's in the range of the last 20 years. What do you see? Inflation over the last 20 years has been kind of boring, no?

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

This is funny

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

I see cycles in that chart. And a current price that's in the range of the last 20 years. What do you see? Inflation over the last 20 years has been kind of boring, no?

The last 3 months have the fastest rising prices for Raw Materials in 20 years up 12 percent in 9 months, nearly equal to the drop in 2008 as the economy was dropping. That resulted in the FED creating QE to halt that problem (see video above), what equivalent do you think the FED will do in response to this, with 2 trillion of unfunded government spending about to hit the US economy?

In 2008, the last time raw material prices were rising this fast the 10 year treasury was trading at 4.2%, the 2010 surge which was at 1/4 the speed of this one saw 10 year treasuries increase to 3.86%.

In 2017 the 10 year went from 1.5 to 3.1 before the FED abondoned ending QE and getting to where we are today.

I will agree something is happening Mr Jones

Inflation typically refers to CPI over sustained periods of time, not snapshot views of specific commodity prices. So, for those who feel the rate of inflation is going to increase or already increasing:

What rate do you project for inflation and when does it reach that level?

Edit to add - the most recent BLS showed 0.3% in January and 1.4% for the previous 12 months. https://www.bls.gov/news.release/pdf/cpi.pdf

What rate do you project for inflation and when does it reach that level?

Edit to add - the most recent BLS showed 0.3% in January and 1.4% for the previous 12 months. https://www.bls.gov/news.release/pdf/cpi.pdf

Last edited:

24601NoMore

Thinks s/he gets paid by the post

- Joined

- Dec 8, 2015

- Messages

- 1,166

Inflation typically refers to CPI over sustained periods of time, not snapshot views of specific commodity prices. So, for those who feel the rate of inflation is going to increase:

What rate do you project for inflation and when does it reach that level?

At least 3% (conservatively - possibly as much as 3.5% or higher) by end of 2021. Certain segments of the economy - housing, energy, etc - much higher, as we're already seeing.

By the end of the current administration's term (12/2024): 5 - 8% core.

The multiple, multi-trillion dollar spending bills either already passed (since 3/2020) or being talked about and likely to be passed are gonna flood the economy with newly printed $$s. That's going to hit existing savings hard (by devaluing the $$ retirees have saved) - just look at the DXY since Oct of last year, or better, Jan 2020 - DXY is down roughly 10% since then. It's also going to hit stocks as the "risk premium" gets thrown out of kilter. We're already seeing that in a big way this week with the NAS getting hit hard. Assuming inflation does rise to 3+% this year, markets are likely to get hit across the board. I know there are a lot of experts predicting 4,200 or higher on the S&P by EOY..but I just don't see it, and for that reason am investing in Value and Emerging Markets (eg: Asia, particularly China) because my faith in US equity returns (especially Growth) this year is not high..in fact, I think inflation is going to be the pin that pops the balloon and 2021 is likely to be painful in terms of US markets - JMHO and guess we'll see.

And it's not just one commodity like gas..we're seeing housing prices up +10% YTY and many other indications of significant inflation already happening since 1/1/21. Look at pretty much any commodity..lumber is crazy (thank God I didn't buy that retirement property we were going to build a new house on!). Ditto copper. Etc. Those of course hit new construction housing but food commodity and other prices are up significantly so far in 2021, and likely to go much higher with all the new spending.

I prefer the personal inflation rate to any trailing selective CPI number for actual inflation. Personally I'm looking at future purchases which we'll need to make. HVAC this year, car next year, etc. These will have a significant impact was well as the taxes and various insurance policies which may be the 800# gorilla.

Similar threads

- Replies

- 12

- Views

- 3K

- Replies

- 34

- Views

- 5K