tominboise

Recycles dryer sheets

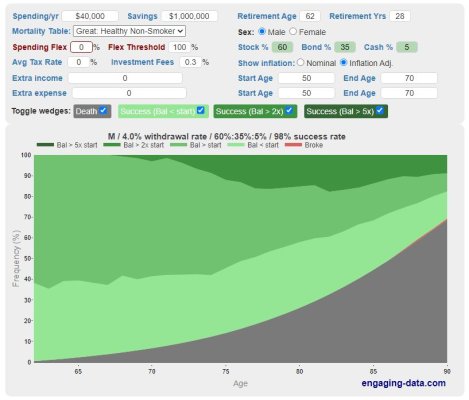

I am 62, my wife is 60 and we retired in Oct of 2020. We have been withdrawing at about 4% (actually slightly less at 3.8%) and my elaborate forecasting spreadsheet shows that going forward based on our current assets and assumptions. When we start drawing SS at 70, our withdraw rate will drop to the 1.8% range or so. These numbers are based on our actual spending over the last 19 months, which matches up with the budget we had put together.

Our current AA is about 60/35/5.

Based on this, I think we should be good for the rest of our time here on earth, barring some calamity (nuclear war, etc)?

Our current AA is about 60/35/5.

Based on this, I think we should be good for the rest of our time here on earth, barring some calamity (nuclear war, etc)?