So let me get this straight, you "know" how banks work and you think banks still write mortgages?

So banks aren't involved in mortgage lending? Where are you borrowing from?

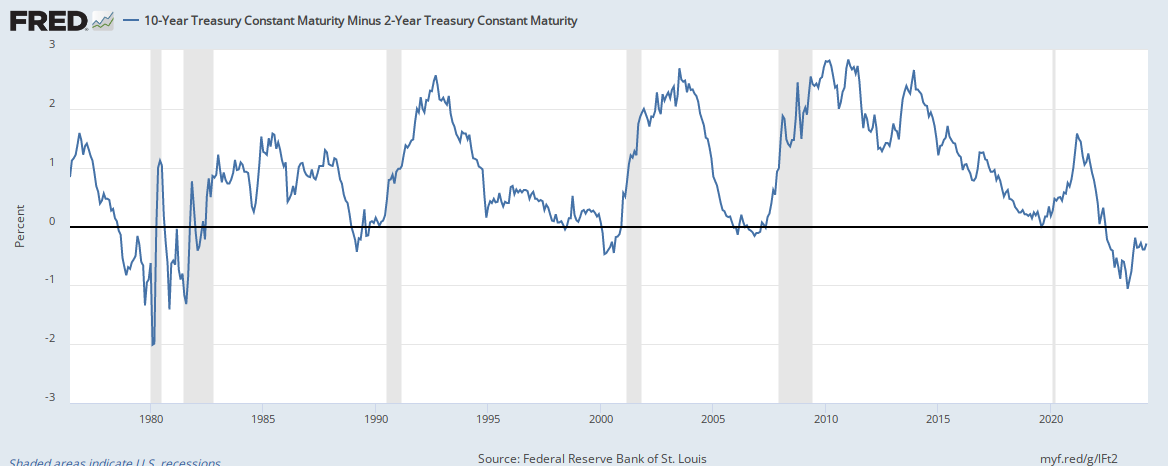

The spread ( yield curve) is the difference between long-term and short-term rates, which also serves as a proxy for loan profitability for banks. Banks' core business is to borrow short (e.g., deposit accounts) to fund longer-term loans (e.g., mortgages, car loans, etc.), so the more long-term rates exceed short, the more money the bank would make. Hence, a positive spread would likely encourage banks to lend to capture the profit, and more plentiful capital stimulates economic growth. That's what we have here.

It's really not that difficult guys. If you look at all my statements on this thread they are pretty consistent and accurate. Don't know what else to say.

and to my original point:

The importance of the yield curve to future growth is why The Conference Board's forward-looking Leading Economic Index (LEI) uses the interest rate spread of 10-year Treasurys less federal funds-it provides a telling sign about the upcoming economic environment.

Last edited: