You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Your input on options for 2021 income

- Thread starter Scuba

- Start date

BubbaChris

Recycles dryer sheets

Playing into the LTCG angle, a huge portion of our taxable account gains are from an S&P mutual fund. So I am just starting to research using specific ID’s rather than average cost to maximize the gains on this year’s sales, then repurchase the same fund with what we won’t need in the next year since wash-sale rules only apply on losses.

This is all so new to me, I’m sure if this makes sense. My thought is I could sell the most recent purchases via specific ID’s should we want to get cash for an unplanned expense and don’t want to tap our ROTH yet.

Best regards,

Chris

This is all so new to me, I’m sure if this makes sense. My thought is I could sell the most recent purchases via specific ID’s should we want to get cash for an unplanned expense and don’t want to tap our ROTH yet.

Best regards,

Chris

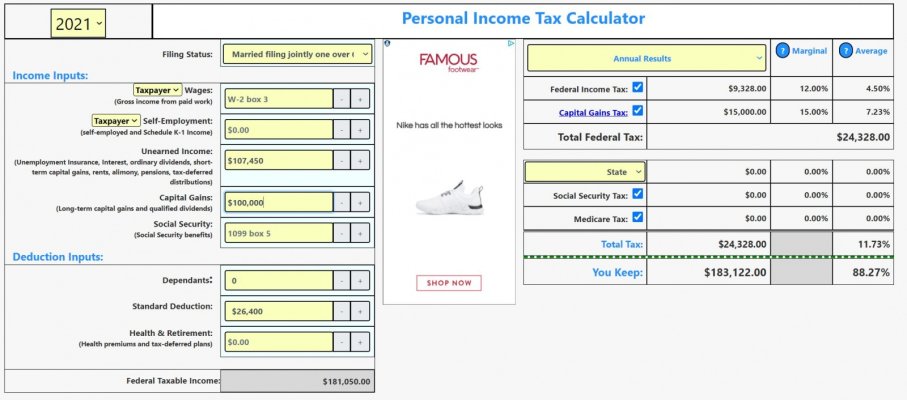

Assuming that you are MFJ over 65 and had no other ordinary income, you could have as much as $107,450 of Roth conversions and pay $9,328 in tax (8.68%).... then any preferenced income (qualified dividends and LTCG) on top of the $107,450 of ordinary income would be taxed at 15%.

So your savings would be what you would pay on that amount at RMD time vs the 8.68%... so if you expect RMDs to be taxed at 22% then you would save $14,312 [$107,450 * (22% -8.68%)].

You can use https://www.irscalculators.com/tax-calculator to test different scenarios.

Thank you!

Playing into the LTCG angle, a huge portion of our taxable account gains are from an S&P mutual fund. So I am just starting to research using specific ID’s rather than average cost to maximize the gains on this year’s sales, then repurchase the same fund with what we won’t need in the next year since wash-sale rules only apply on losses.

This is all so new to me, I’m sure if this makes sense. My thought is I could sell the most recent purchases via specific ID’s should we want to get cash for an unplanned expense and don’t want to tap our ROTH yet.

Best regards,

Chris

This makes sense to me. We have done this before and it worked well for us.

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,249

Yes, as long as you haven't sold from that fund using average cost already. Once you've used average cost, you have to stick with it, because you've essentially sold a portion of each share.Playing into the LTCG angle, a huge portion of our taxable account gains are from an S&P mutual fund. So I am just starting to research using specific ID’s rather than average cost to maximize the gains on this year’s sales, then repurchase the same fund with what we won’t need in the next year since wash-sale rules only apply on losses.

This is all so new to me, I’m sure if this makes sense. My thought is I could sell the most recent purchases via specific ID’s should we want to get cash for an unplanned expense and don’t want to tap our ROTH yet.

Best regards,

Chris

If you have both covered and non-covered shares those are treated separately. So if you've sold non-covered shares with avg cost but not covered shares, you can use SpecID for the covered shares.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

In taxable accounts you ALWAYS want specific ID.

This has been a public service message.

This has been a public service message.

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,249

I agree, though back when I was auto investing every month and reinvesting dividends before 2011 that would be a lot to track on my own. And I sold some using their provided avg cost basis so I'm stuck with that for the old shares. Not that it matters too much as they all are low basis. Everything newer I have as SpecID.In taxable accounts you ALWAYS want specific ID.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

In taxable accounts you ALWAYS want specific ID.

This has been a public service message.

+1 nothing lost by going SID.

Out-to-Lunch

Thinks s/he gets paid by the post

In taxable accounts you ALWAYS want specific ID.

This has been a public service message.

Yeah, I agree. However, where were you in 1997 when I needed you?

In taxable accounts you ALWAYS want specific ID.

This has been a public service message.

This is where I think a FA could be helpful for us. This is what we were told as well, but it was an offhand comment, so I’m only starting to appreciate the ramifications.

The other bit of advice was to sell where you had minimal gains. Which seems counter to the ‘take your tax hit now’ advice for Roths. My instinct was to try to pull from different accounts to normalize our basis to an average. The more we let those accounts grow, the greater gains we’re going to have to deal with later. I assume the reason behind taking the lower gain positions earlier is so you can take advantage of a down market to harvest some of those higher gain positions? But then would’t you just have losses in the other positions?

I haven’t tried running any math here, so just repeating what we were told. I’m surprised this topic doesn’t come up more frequently here.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yeah, I agree. However, where were you in 1997 when I needed you?

I knew it then but you never called.

But then again I'm a CPA with a tax background so I probably had a leg up.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This is where I think a FA could be helpful for us. This is what we were told as well, but it was an offhand comment, so I’m only starting to appreciate the ramifications.

The other bit of advice was to sell where you had minimal gains. Which seems counter to the ‘take your tax hit now’ advice for Roths. My instinct was to try to pull from different accounts to normalize our basis to an average. The more we let those accounts grow, the greater gains we’re going to have to deal with later. I assume the reason behind taking the lower gain positions earlier is so you can take advantage of a down market to harvest some of those higher gain positions? But then would’t you just have losses in the other positions?

I haven’t tried running any math here, so just repeating what we were told. I’m surprised this topic doesn’t come up more frequently here.

You know, no one here is average. Perhaps it is one of those things people assume is known. So use specific ID on taxable accounts. Always.

Another trick: Don't reinvest dividends automatically in taxable accounts. Instead, gather all your dividends and make a new investment in your most favored security. Avoid those tiny positions (though these days your broker keeps all the records, so it is not the hassle it once was).

In tax deferred or Roth, reinvest however you want.

As far as hiring an FA, I think a fee only advisor you talk to once a year is valuable. If you have a CPA do your taxes, they should be training you about basis rules, avoiding wash sales, etc.

As far as the advice you have been given, ask questions. I don't think your goal of selling a security is to generate little gain. You are making an investment decision. But given you have decided, for example, to sell 50 shares of a 300 share position in General Motors in your taxable account you want to choose the highest basis shares, generally speaking. It keeps taxes low, leaving you more to invest.

You want to defer paying taxes, generally speaking, unless you find yourself in a lower than usual tax bracket, which can happen when one or both spouses retire, for example. Under current law, basis gets reset at fair market value upon death and untaxed gains disappear. So large deferred gains are desirable, not an annoyance. And as stated you can recognize gains opportunitistically when your tax rate is low, if desired.

If you also make charitable contributions, you may use appreciated stock for doing so. Your tax deduction will be equal to the fair market value of the shares transferred, and the gain is never taxed. Your FA or CPA can provide important details for executing this.

You may also want to opportunistically recognize losses to reduce taxes.

The "take the tax hit now" view is tied with Roth conversions, which may make sense in very unique circumstances. You certainly want to make sure you know the numbers inside and out before doing so.

This is pretty basic but there is a good bit here to consider. I suggest you discuss these ideas with your FA or CPA to determine what is right for you.

Best of luck and good investing.

Monte

Last edited:

You know, no one here is average. Perhaps it is one of those things people assume is known. So use specific ID on taxable accounts. Always.

Another trick: Don't reinvest dividends automatically in taxable accounts. Instead, gather all your dividends and make a new investment in your most favored security. Avoid those tiny positions (though these days your broker keeps all the records, so it is not the hassle it once was).

In tax deferred or Roth, reinvest however you want.

As far as hiring an FA, I think a fee only advisor you talk to once a year is valuable. If you have a CPA do your taxes, they should be training you about basis rules, avoiding wash sales, etc.

As far as the advice you have been given, ask questions. I don't think your goal of selling a security is to generate little gain. You are making an investment decision. But given you have decided, for example, to sell 50 shares of a 300 share position in General Motors in your taxable account you want to choose the highest basis shares, generally speaking. It keeps taxes low, leaving you more to invest.

You want to defer paying taxes, generally speaking, unless you find yourself in a lower than usual tax bracket, which can happen when one or both spouses retire, for example. Under current law, basis gets reset at fair market value upon death and untaxed gains disappear. So large deferred gains are desirable, not an annoyance. And as stated you can recognize gains opportunitistically when your tax rate is low, if desired.

If you also make charitable contributions, you may use appreciated stock for doing so. Your tax deduction will be equal to the fair market value of the shares transferred, and the gain is never taxed. Your FA or CPA can provide important details for executing this.

You may also want to opportunistically recognize losses to reduce taxes.

The "take the tax hit now" view is tied with Roth conversions, which may make sense in very unique circumstances. You certainly want to make sure you know the numbers inside and out before doing so.

This is pretty basic but there is a good bit here to consider. I suggest you discuss these ideas with your FA or CPA to determine what is right for you.

Best of luck and good investing.

Monte

Wow, that was incredibly helpful. Thank you!! And gave me some good places to get started with Google to learn more.

We’ll be starting to draw down accounts next year, so taking the dividends instead of reinvesting them, and clearly need to get smarter on these things than we are. Everything is in mutual funds, so we don’t have the individual equities, but we do have a mush mash of funds. Dumb, but I hadn’t considered the step up in basis.

We have a call with our cpa to discuss some of this in a few weeks, but I haven’t been thrilled with them so far.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Wow, that was incredibly helpful. Thank you!! And gave me some good places to get started with Google to learn more.

We’ll be starting to draw down accounts next year, so taking the dividends instead of reinvesting them, and clearly need to get smarter on these things than we are. Everything is in mutual funds, so we don’t have the individual equities, but we do have a mush mash of funds. Dumb, but I hadn’t considered the step up in basis.

We have a call with our cpa to discuss some of this in a few weeks, but I haven’t been thrilled with them so far.

You get step-up in taxable accounts for both individual equities and mutual funds.

Most CPAs, even most tax practitioner CPAs, are not well versed on retirement drawdown strategies... it's just not something that the do regularly. You might be better off to find a CPA that is a PFS (Personal Financial Specialist).

https://us.aicpa.org/forthepublic/financial-planning-resources

https://account.aicpa.org/eWeb/dynamicpage.aspx?webcode=referralwebsearch

Similar threads

- Replies

- 29

- Views

- 3K