nun

Thinks s/he gets paid by the post

- Joined

- Feb 17, 2006

- Messages

- 4,872

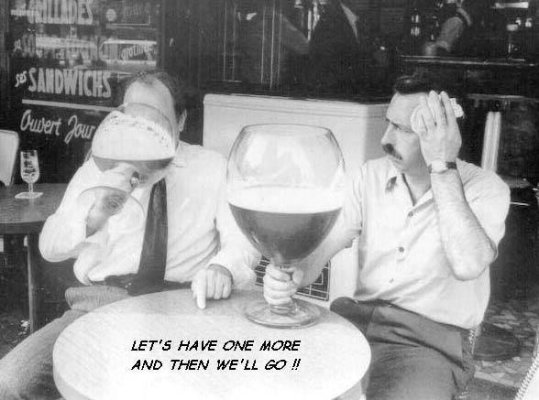

Just had a few beers with two old friends; one is a risk manager for a major bank and just left the Boston Fed and the other is a CFA and a partner in an insurance consultancy. They are both middle aged with kids, big mortgages on nice homes and stressing that they see very little upside in equities. They don't see much chance of growth on the West, bubbles in the East and systemic issues like aging populations for most economies. Their solution is to sell all stocks and bonds and buy rental real estate........I suggested investing something in Africa, or just maintaining a diversified portfolio just in case.....don't put it all in one sector ........your thoughts?

Last edited: