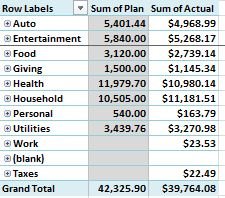

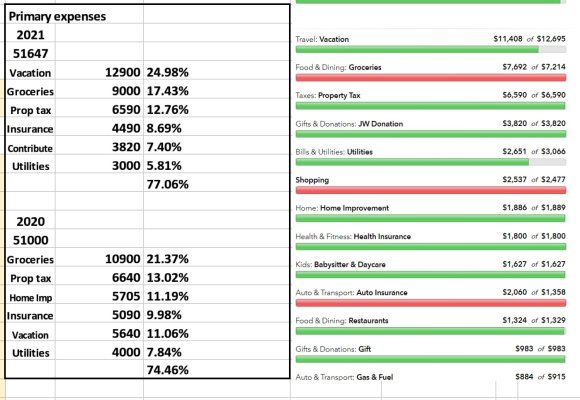

I had to wait for the year to end. As I have mentioned before, we still track every Penney spent and break the categories down quite a bit. This was our expenditures for 2021. Interestingly, it was all covered by our Social Security income.

Expenses

Automobile

Emission Inspection $25.00

Gasoline $101.46

Misc. $756.95

Plates $171.09

Supplies $46.87

Automobile - TOTAL $1,056.38

Bank Charge

Service Charges $3.10

Bank Charge-Other $6.95

Bank Charge - TOTAL $10.05

Charitable Donations

Deductible $80.00

Charitable Donations - TOTAL $80.00

Clothing

Brenda $33.42

Ron $58.95

Clothing - TOTAL $92.37

Computer

Hardware $1,290.01

ISP & DSL $1,001.20

Software - Invst Mgmnt $279.48

Software - Non-deductible $1,165.23

Software - Tax Prep $19.94

Supplies $1,133.49

Wireless Broadband $302.44

Computer - TOTAL $5,191.79

Dining Out $58.22

Gifts

Personal $318.27

Gifts - TOTAL $318.27

Groceries $7,092.56

Healthcare

Co-Pay $606.96

Deductible $703.96

Hearing $459.17

Non-Prescription $86.00

Other $330.51

Healthcare - TOTAL $2,186.60

Home

Furnishings $540.15

Garden $19.80

Kitchen $335.92

Maintenance $156.77

Misc $193.14

Postage $64.75

Security $587.73

Supplies $805.93

Home - TOTAL $2,704.19

House $1,441.00

Insurance

Automobile $1,573.18

Brenda - Health $1,782.00

Homeowner's-Renter's $1,367.00

Roadside Assistance $169.00

Ron - Health $1,782.00

Insurance - TOTAL $6,673.18

Investing

Deductible Expenses $1,162.91

Investing - TOTAL $1,162.91

Investment

Deductible Expenses $790.00

Investment-Other $1,000.00

Investment - TOTAL $1,790.00

Leisure

Audio/Video $167.89

Birds $154.26

Books & Magazines $139.94

Entertaining $17.95

Genealogy $15.00

Newspapers $577.90

Photography $536.71

Television $3,379.29

Leisure - TOTAL $4,988.94

Liquor

Brenda $461.44

Ron $2,036.31

Liquor-Other $412.55

Liquor - TOTAL $2,910.30

Membership

Buying Club $322.00

Organizations $32.00

Membership - TOTAL $354.00

Personal

Gifts $1,004.96

Personal Care $214.35

Personal - TOTAL $1,219.31

Personal Care $54.91

Taxes

Colorado Sales Tax $1,281.88

Federal Income Tax ($2,659.02)

Ownership Tax $6.00

Real Estate Taxes $987.56

Taxes-Other $11.34

Taxes - TOTAL ($372.24)

Travel

Membership $33.00

Travel - TOTAL $33.00

Utilities

Gas & Electric $3,450.05

Telephone $3,604.65

Water-Sewer-Garbage $502.24

Utilities - TOTAL $7,556.94

Expenses - TOTAL $46,647.67