corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

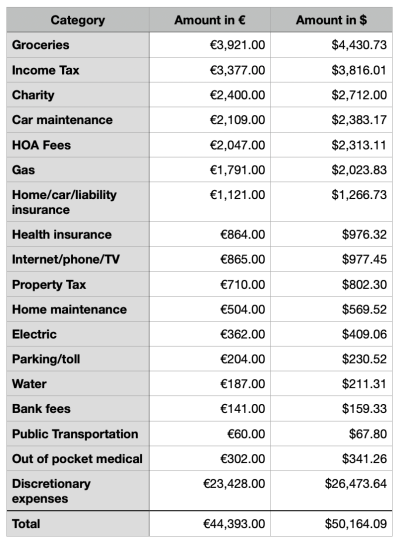

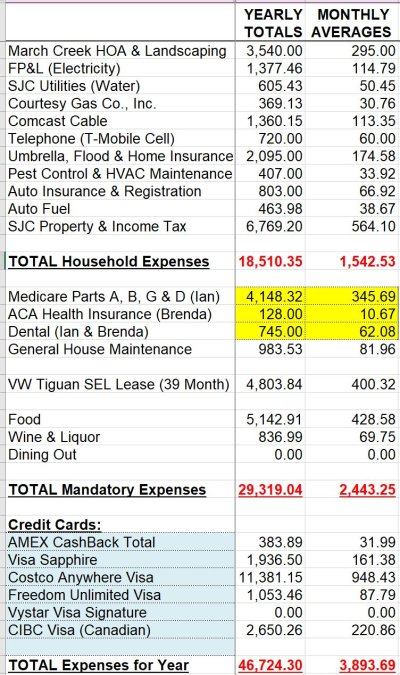

Retired 21 Mar of this year @ 55. Spend outlined below. $258,310 so far. Didn't plan on spending that much but we have $29k more in savings than when I retired. So there's that.

Oops, need to add in taxes of $160,966. So $419,276. Severance was pretty big.

Oops, need to add in taxes of $160,966. So $419,276. Severance was pretty big.

Attachments

Last edited: