We are well on our way to retirement. Already achieved FI.

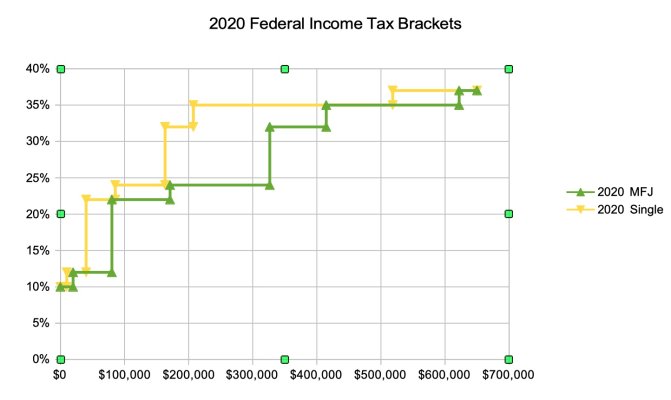

One theme that keeps coming up is that taxes eat up a bigger chunk after a spouse passes. So right now our income is a combination of a COLA pension+invested assets.

Upon my spouses death, I will get 60% of the COLA'd pension plus enough from life insurance to make up the difference. So the only thing to consider for taxes is.

1. One less deduction

2. medicare cliff

So even if I will be paying more taxes/medicare, my expenses will decrease.

We are all healthy, just trying to consider all scenarios. What am I missing?

One theme that keeps coming up is that taxes eat up a bigger chunk after a spouse passes. So right now our income is a combination of a COLA pension+invested assets.

Upon my spouses death, I will get 60% of the COLA'd pension plus enough from life insurance to make up the difference. So the only thing to consider for taxes is.

1. One less deduction

2. medicare cliff

So even if I will be paying more taxes/medicare, my expenses will decrease.

We are all healthy, just trying to consider all scenarios. What am I missing?