Ok, let's do this!

Disclosure: I'm not an expert and probably made some computation mistake here.

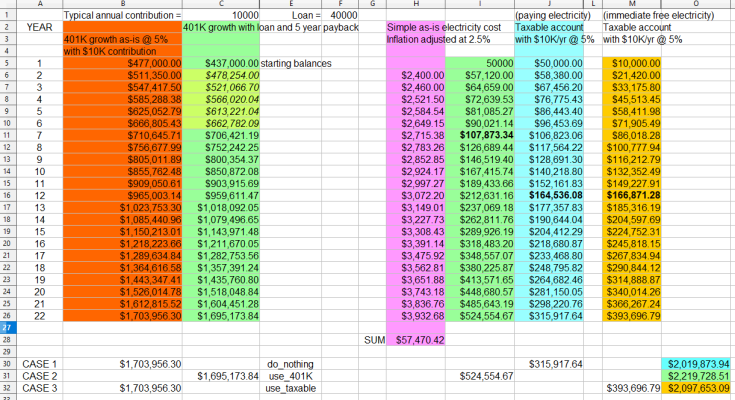

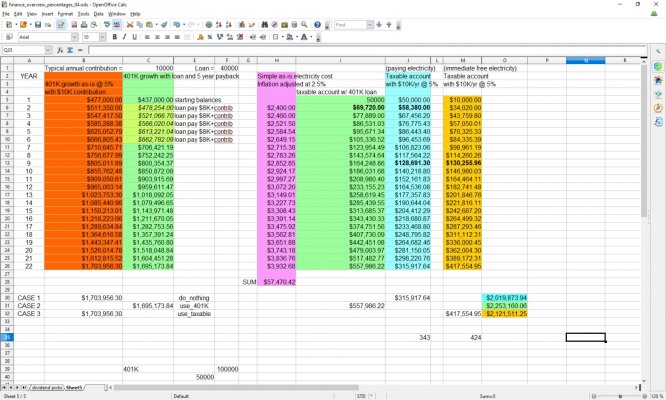

Assumptions:

- target of contributing $10K/yr pre-tax to 401K

- 401K is making 5% average annual return (broad/blended funds)

- target of contributing $10K/yr into a taxable (broker) account

- broker account is also making 5% annual return (maybe 5-8% REIT/dividend/CEF/etc)

- cost of electricity rises with the inflation rate of 2.5%

- electric bill is $2400/yr ($200 a month)

Some comments:

- over 22 years, you're going to pay $57K in electricity

- the "loan" of $40K represents sufficient home improvements to bring the electric bill to effectively $0 (or like a 90% drop); this is parts and labor. While you could spend less, it might not achieve the $0 electric bill.

- Basically I play the model has $10K to 401K, $10K to taxable account -- counting that as basically disposable money; you obviously make over $20K/yr, so the rest of money is in your other bills (TV/phone/food), taxes, and the reserve bank account (insurance, saving up for vacation, or perhaps multiple other taxable accounts, etc). YMMV.

I "ran" this model for 22 years, just because. We're not talking early investors still paying loans/mortgage, but the more "mid-career" people with 10-20 "years to go" till retirement (full no-penalty access to 401K).

I'm organizing the results into three cases, summarized here. The numbers are in the chart below.

CASE 1: Do Nothing (total $2.0M)

Your 401K and broker account both accrue at their 5%. Since you're still paying your electric bill, the way I modeled this is that I subtracted the ~$2400/yr bill from what you could have potentially invested in the brokerage. In reality, you probably still have more income and could still achieve the full $10K plus your electric bill. But to be more apples to apples, I maintain the model as: by having an electric bill, that translates to having slightly less to invest than you could have. I think that's fair since, either way, it means less spending money for you to pay that bill.

CASE 2: Use the 401K Loan (total $2.2M)

This is where people will challenge that I've probably done something wrong -- I hope they spot it, because this does look good! So, in this case...

Since you installed the solar improvements, you start saving the $2400/yr immediately. But you have to commit to paying off the 401K loan, which we decide to do $8000/yr ($700/mo). This means for awhile you have less to contribute to the taxable account (because you're using it to pay the 401K loan), but you still want to max out the 401K contribution (yes, it may technically be $19K -- I just put $18K; reason being is because you pay the 6% interest to yourself, so leave a little wiggle room for that to avoid hitting the cap {unsure if that applies in this case, but just in case}). You do this for about 5 years, and remember you're also not paying electricity for those 5 years.

Then the way I modeled this: after having paid the loan off, now you also have $2400 extra to contribute to the taxable account. You "break even" relative to CASE 1 in year 7 (very shortly after finishing the loan payoff).

There are a couple caveats that make this hard to model: (1) within 10 years, the system is now less efficient than it used to be (most likely). On the flip side, recall you might sometimes get a surplus and get paid back for the electricity produced (just depends on the situation). (2) At this 7 year mark, you might be able to retire, again just depending in your particular situation (such as if you're able to pull from the 401K). By itself, the $107K taxable account won't be enough, but presumably (if incline to retire early) any other extra income might be used for multiple taxable accounts (but to be fair, only one of them gets the benefit of also having what used to be spent on electricity is now sent to investing -- which is the one we're modeling here).

The interesting point here is that your $40K loan has barely dented the 401K balance (relative to CASE 1, just doing nothing). But again, this is hard to model, since it depends on what kind of years those aggressive $8000/yr payback have gone (but that's why we do the conservative 5%). Another 401K loan fact that I don't think has been mentioned yet: you're only allowed one loan, so this is it, don't depend on the 401K for additional emergency loan (until after the 5 years and this current one is paid).

My interpretation here is that your original $40K loan has "cost" ~$10K (just by the delta between not having taken the loan in the final balance), which is then offset in year 8 by not having to pay electricity (and the on). And as mentioned, the other subtle benefit here is that you've kept a sizable taxable account that is very liquid (maybe at most like a 3-day waiting period to move money around, but it's your money to do as you please -- so this becomes your main emergency backup for awhile).

CASE 3: Use your Taxable Account Directly ($2.1M)

In this case, you haven't touched the 401K, and used a big chunk the taxable account. But similar to CASE 2, you start saving electricity immediately and could route that now-unspent-money to accelerate the taxable account investments (which is what this model does). Yes, both CASE 3 and CASE 1 do also take into account paying income tax on this (hence you don't gain the full 5% annual return).

It still takes 11 years to accelerate past the "do nothing" case -- though again, this presumes the caveats of the equipment still being operational and efficient towards effectively providing no-electric bill.

So, there it is -- the case that if you have good standing in a good job, with a highly likely 5-10 years to go, the 401K loan option might make sense in this situation. But two more things:

(1) I haven't even yet considered the 30% tax credit implication on all this. Maybe I'll get to that tomorrow.

(2) My tentative view here is that is a bit of a wash. I'm inclined to agree that as electrical needs rise, broader larger scale solutions will present themselves (solar/wind farms), and continue to keep energy cost down (with some exceptions at certain locations, I am sure). Basically, just the "threat of solar" I think helps motivates power grids to be efficient and fair. In other words, I agree it might be a better use of resources overall for large industrial clean-energy solutions, rather than the overhead of maintaining upteen-million individual residential solar power systems. I wouldn't interpret this as the solar options are "saving" over $100K, since it doesn't account also for the loss in efficiency of the equipment, or just the general maintenance (even replacing a single microinverter is your time, thought, distraction of just doing it -- days become precious as we get older!) That's why I call it a wash -- while $100K-$200K is good money, it's still well within the noise of the model itself (i.e. it might not really pan out that way). Clearly, YMMV (if you've inherited a chunk of change, this does convey that the PV system would pay for itself within 7-12 years, so in that sense it might be suitable for a younger person)

That said, I'm interested in the up and coming Tesla solar cells that look like shingles. The next time our roof altogether needs replacement (in another 10-15 years), maybe then the technology will be worth looking into -- meanwhile, I can incrementally work on other parts myself (water heater, radiant barrier, etc.).

NOTE: To quickly clarify how "taking a loan improves your 401k" indicated by the chart, keep in mind the context: the model assumes a nominal $10K pre-tax contribution to the 401K. But then because of the loan -- even though just temporarily (5 years), you're accelerating the contribution to near max-contribution level ($10K + $8K + ~6% interest). By year 4, this increase overshoots what you originally would have contributed.

Our home is 100% electric. No natural gas available in our area.

Our home is 100% electric. No natural gas available in our area. Our home is 100% electric. No natural gas available in our area.

Our home is 100% electric. No natural gas available in our area.