4 years ago I decided I really needed to get LTC covered, so my kids wouldn't get stuck with it. The premiums were going to cost $1000-$1500 a month, basically until I died or went into care. But it took forever to get through the medical qualification process, and before they dotted the last i, I had prostate cancer. My agent said no problem, get it treated and when you have 5 years clean, they'll take you. Then I got lymphoma, and he said uh, have a nice life ... With two cancers nobody would touch me, so I figured I'd just have to self-insure. Which, if I ended up in full care like my mom, would blow through $100k a year or more.

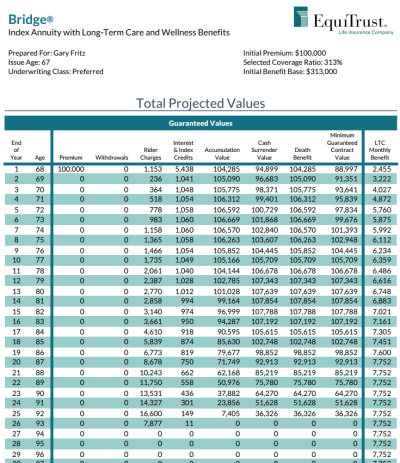

I've been talking to a CFA who has a different annuity-based product that doesn't require medical underwriting. You just have to demonstrate you're in reasonably good condition: balance OK, memory OK, etc. Instead of monthly LTC premiums (which would have racked up about $72k in monthly payments in the last 4 years, with lots more to come), for this program you just drop $100k into it and then you're done. There's a ramp-up vesting period but after 5 years it'll pay me about $6k/mo if I need care. There's no inflation-tracking clause but it does grow slowly at 2%/yr, so it's $5700 after 5 yrs, $7000 after 15 yrs, etc. (But I just discovered the 2%/yr growth STOPS when you start benefits. You're stuck at the level you start at, even during the initial 5-year vesting period. That's a big problem.)

It wouldn't cover everything if I ended up in full-care nursing home like my mom did, but it would definitely help. And it would probably cover everything if I just need assisted living or similar.

If you don't need care, most of the $100k comes back to the kids. It ends up being like a $100k life insurance policy, for the first 17-18 yrs or so. After that the policy value starts to evaporate, so you might want to pull the $100k out at that point. (Your numbers will probably be different.)

So that's much better than I thought I'd be able to find. And actually better than traditional LTC insurance, if I understand it right. But the lack of inflation protection after benefits start is a big problem. The insurer's rating is also marginal: EquiTrust Life, rated BBB+ (S&P) or B++ (AM Best).

Is anyone familiar with this type of policy? Anything I should beware of?

Are there better answers out there?

I've been talking to a CFA who has a different annuity-based product that doesn't require medical underwriting. You just have to demonstrate you're in reasonably good condition: balance OK, memory OK, etc. Instead of monthly LTC premiums (which would have racked up about $72k in monthly payments in the last 4 years, with lots more to come), for this program you just drop $100k into it and then you're done. There's a ramp-up vesting period but after 5 years it'll pay me about $6k/mo if I need care. There's no inflation-tracking clause but it does grow slowly at 2%/yr, so it's $5700 after 5 yrs, $7000 after 15 yrs, etc. (But I just discovered the 2%/yr growth STOPS when you start benefits. You're stuck at the level you start at, even during the initial 5-year vesting period. That's a big problem.)

It wouldn't cover everything if I ended up in full-care nursing home like my mom did, but it would definitely help. And it would probably cover everything if I just need assisted living or similar.

If you don't need care, most of the $100k comes back to the kids. It ends up being like a $100k life insurance policy, for the first 17-18 yrs or so. After that the policy value starts to evaporate, so you might want to pull the $100k out at that point. (Your numbers will probably be different.)

So that's much better than I thought I'd be able to find. And actually better than traditional LTC insurance, if I understand it right. But the lack of inflation protection after benefits start is a big problem. The insurer's rating is also marginal: EquiTrust Life, rated BBB+ (S&P) or B++ (AM Best).

Is anyone familiar with this type of policy? Anything I should beware of?

Are there better answers out there?