PERSonalTime

Recycles dryer sheets

- Joined

- Jan 19, 2014

- Messages

- 456

Hey, does your organization offer any kind of pension program? If so, do you have one and what is it like? Also, do you also have any other source of retirement income?

Hey, does your organization offer any kind of pension program? If so, do you have one and what is it like? Also, do you also have any other source of retirement income?

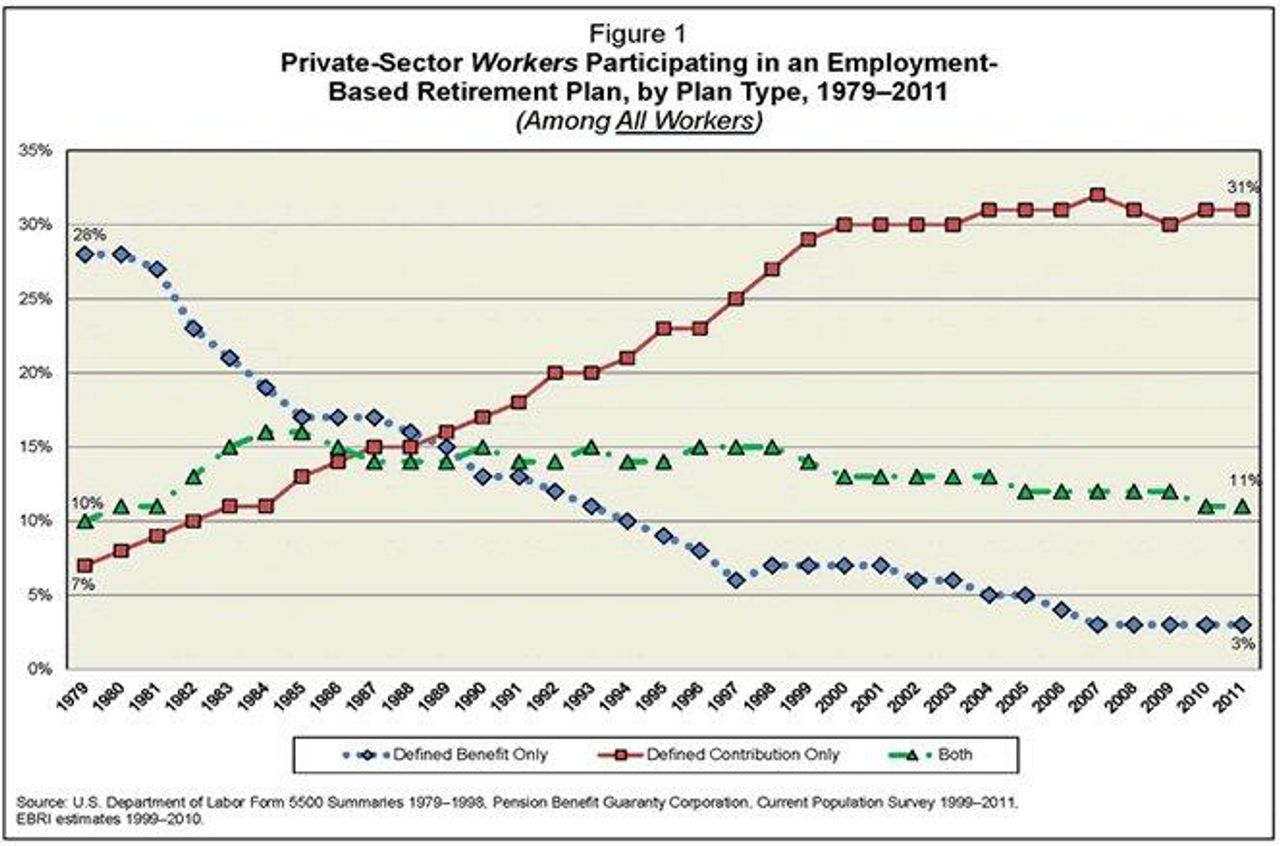

Yes I have a pension, however, my organization moved from the type I have (defined benefit) back in the early 80's. What's it like? I think it's going to be wonderful getting a monthly deposit, which is more than what I brought home when I was working. I have a TSP (401k type federal contribution plan) however my pension covers my living expenses and savings.