Retire with less than $500,000?

Not too much more than that, and after 24 years of retirement, still in pretty good finanacial shape.

This is a good time to restate my Phase II theory of retirement. Very simple. A look ahead to the slow-down time of life, with a plan that could change the basic planning in the early years... (age 45 to 62 for example) and allow for more expenses in the early years. Ie... If you planned to retire at 60, you might be able to retire at 55.

My experience only... as DW and I are well past the 3/4 centiry mark.

We're slowing down. Happily. and looking realistically for the time between now and age 90.

So it comes down to: "How long will my money last".

Planning for the future became easy, when we discovered the actual costs of our Continued Care Retirement Community. Apartment living. 2BR,2BA 750sf.,

Following included:

Rent, Heat, Electricity, Water, Cable TV, Internet, 2 meals/day, light housekeeping 1/wk, free transportation to Medical, Shopping, Entertainment, and in house health and recreation facilities. No more taxes, fees, maintenance or ancillary costs

Cost for two persons... $2500/month or $30,000/yr. Add $10,000 yr for healthcare.

So from there, to "How Long Will My money Last?"

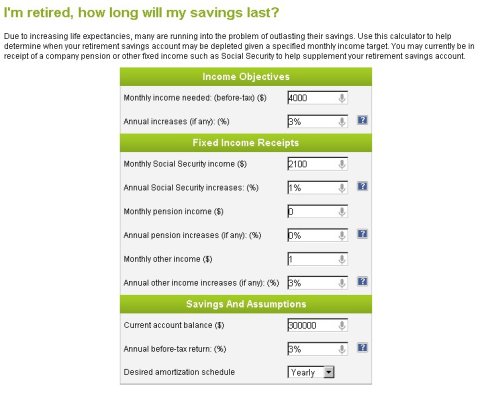

I'm retired, how long will my savings last? | Calculators by CalcXML

I simply used an asset figure (savings) of $300,000, and a required income figure of

$4000/month, and placed it in the calculator as in the files below, to see how long it would last. (That's $8000/yr more than basic total cost.)

According to the calculator that would cover us until age 90. See the charts.

We're actually in better shape than the figures shown in the charts, but use the numbers as a way to look at the later years as apart from the normal retirement charts, which are BASED on the first year's expenses and projected for the entire retirement period, without recognizing the lower costs of the later years.