Hi all, I'm a 30 year old male and I'm struggling with formulating a long term plan other than just being a natural saver.

I don't know if I will ever get married, and I do not know if I will ever have kids. How do you plan for spending a couple decades out when there are such major unknowns in your future life?

When I was in my mid 20s, I purchased a condo at the persuasion of my parents when they had the first time homebuyer tax credit. I lived there for 3 years to satisfy the terms of the credit, and I rented it out for a couple years after that. I did not like being a landlord, so I sold that condo this year for a decent profit which is covered by the personal residence exclusion.

Currently my net worth stack up like this:

*401k: 36k (70/30 stocks/bonds - stocks are large US value and bonds are US corporates - mix of Vanguard Equity Income and Vanguard Wellesley Income)

*IRA: 50k (65/35 stocks/bonds - stocks are large US Value and bonds are US corporates - Vanguard Wellington Fund)

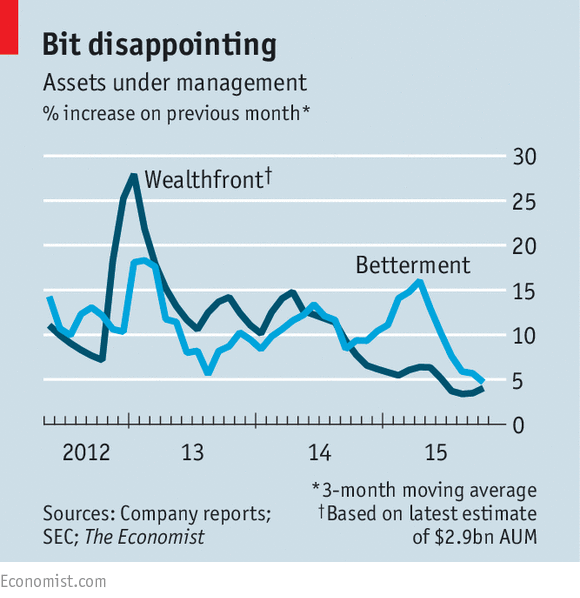

*Taxable Account: 165k (roughly 90/10 stocks/cash - stocks are in Betterment's 100/0 allocation, this is all index funds with an international tilt.

Considering moving away from Betterment and using Vanguard directly, but so far I've had $7500 in tax loss harvesting, yet am positive for the year, and I still have a few more months in the free trial phase...)

I currently have no debt as the mortgage was wiped out when I sold my condo and my auto was already paid off. i currently rent 1/2 of a 2 bed room apartment for $850 in California. I would guess that that If I average out my annualized spending, I spend between $2.5k and 3k per month, including travel, which is less than I earn and could be pared down, but I don't really feel the urgency to as I'm ambivalent towards my job. I've maxed out the IRA every year since 2010, but I'm very limited by what I can put into 401k due to HCE rules and management's lack of interest in implementing a Safe Harbor plan. Thanks for any input...

I don't know if I will ever get married, and I do not know if I will ever have kids. How do you plan for spending a couple decades out when there are such major unknowns in your future life?

When I was in my mid 20s, I purchased a condo at the persuasion of my parents when they had the first time homebuyer tax credit. I lived there for 3 years to satisfy the terms of the credit, and I rented it out for a couple years after that. I did not like being a landlord, so I sold that condo this year for a decent profit which is covered by the personal residence exclusion.

Currently my net worth stack up like this:

*401k: 36k (70/30 stocks/bonds - stocks are large US value and bonds are US corporates - mix of Vanguard Equity Income and Vanguard Wellesley Income)

*IRA: 50k (65/35 stocks/bonds - stocks are large US Value and bonds are US corporates - Vanguard Wellington Fund)

*Taxable Account: 165k (roughly 90/10 stocks/cash - stocks are in Betterment's 100/0 allocation, this is all index funds with an international tilt.

Considering moving away from Betterment and using Vanguard directly, but so far I've had $7500 in tax loss harvesting, yet am positive for the year, and I still have a few more months in the free trial phase...)

I currently have no debt as the mortgage was wiped out when I sold my condo and my auto was already paid off. i currently rent 1/2 of a 2 bed room apartment for $850 in California. I would guess that that If I average out my annualized spending, I spend between $2.5k and 3k per month, including travel, which is less than I earn and could be pared down, but I don't really feel the urgency to as I'm ambivalent towards my job. I've maxed out the IRA every year since 2010, but I'm very limited by what I can put into 401k due to HCE rules and management's lack of interest in implementing a Safe Harbor plan. Thanks for any input...

Last edited:

Keep to the path you are on with high saving rate and investing mainly in equities.

Keep to the path you are on with high saving rate and investing mainly in equities.