Hi All,

I'm curious to know how I'm doing compared to others here. Silly, perhaps, I know. I know that there are some who would say that I'm doing great and others who may say that I'm not doing all that great.

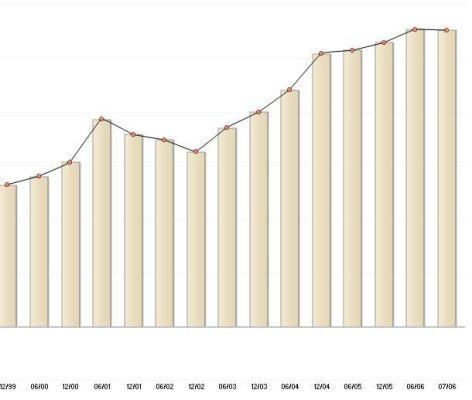

I've been keeping track of our net worth for about a year now and calculated the % change from last year. We had a 10.2% increase. That does not include the home. Does this sound decent? Does anybody keep track of their year-over-year NW increase?

A little about us:

DW: 41

Me: 40

Bottom line (not including home): $881k

Hope to FIRE: ASAP!!!

Thanks in advance for the feedback.

I'm curious to know how I'm doing compared to others here. Silly, perhaps, I know. I know that there are some who would say that I'm doing great and others who may say that I'm not doing all that great.

I've been keeping track of our net worth for about a year now and calculated the % change from last year. We had a 10.2% increase. That does not include the home. Does this sound decent? Does anybody keep track of their year-over-year NW increase?

A little about us:

DW: 41

Me: 40

Bottom line (not including home): $881k

Hope to FIRE: ASAP!!!

Thanks in advance for the feedback.