Hi,

My wife and I have been together a long time but only married recently. We are currently DINK's and track our finances separately.

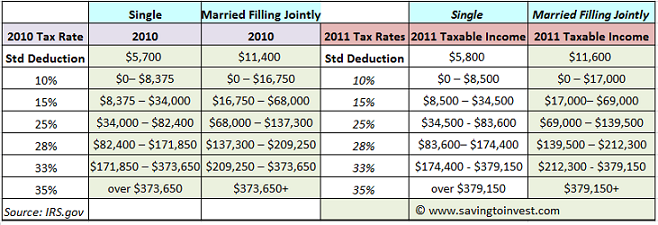

My wife has rental property that she is partnered with her Father on. Because the income limitation on taking up to 25K in rental real estate losses against ordinary income is the same if single or married the difference in her portion of total income taxes single vs married is 51% higher because we are married.

And yes I'm detailed enough I ran our taxes 3 times. Both of us single and then the actual married return.

Our tax code is sooo broken.

My wife and I have been together a long time but only married recently. We are currently DINK's and track our finances separately.

My wife has rental property that she is partnered with her Father on. Because the income limitation on taking up to 25K in rental real estate losses against ordinary income is the same if single or married the difference in her portion of total income taxes single vs married is 51% higher because we are married.

And yes I'm detailed enough I ran our taxes 3 times. Both of us single and then the actual married return.

Our tax code is sooo broken.