Hello,

When I use this input data:

Withdrawals 60,000

Plan End 50

95% Rule from WorkLess, Live More*

Percentage used for 95% Rule* 0

Bernicke Spending Reductions*

Current Age (for scheduling Bernicke spending reductions)* 48

Starting Portfolio 50,000

Percent in Stocks 90%

Expense Ratio 0.04%

Retirement Year* 2032

Contributions until then* 65,000

Social Security* 0

Starting in* 2035

Spouse Social Security* 0

Starting in* 2037

Other withdrawal change* +0

Starting in* 2025

Inflation adjusted* yes

Other withdrawal change* +0

Starting in* 2027

Inflation adjusted* yes

Other withdrawal change* +0

Starting in* 2031

Inflation adjusted* yes

Lump sum change to portfolio* +135,000

In year 2032

Lump sum change to portfolio* +75,000

In year * 2032

Lump sum change to portfolio* +0

In year * 2040

Inflation Rate selected* CPI

Fixed income model * LongInterest

Override start year* 1871

Terminal Value* 0

US Micro Cap** 10

US Small** 10

US Small Value** 10

S&P 500** 40

US Large Value** 40

US LT Treasury** 10

LT Corporate Bond** 15

1 Month Treasury** 5

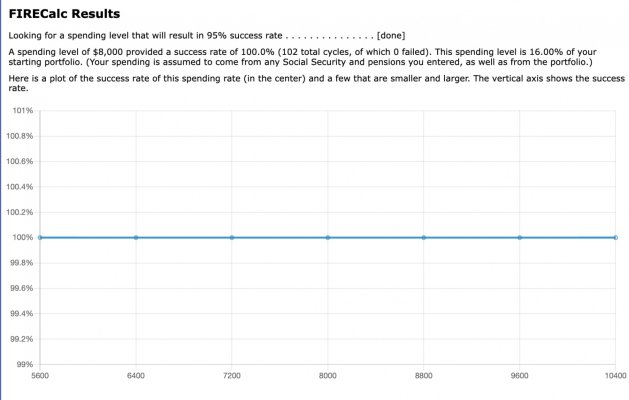

and select "Given a success rate, determine spending level for a set portfolio, or portfolio for a set spending level" in the Investigate tab, I'm getting a flat line in the resulting graph (see attachment) that is only showing very low spending levels:

If I increase the "starting portfolio" value to something high enough, then the resulting graph makes more sense.

Any idea why this is happening?

When I use this input data:

Withdrawals 60,000

Plan End 50

95% Rule from WorkLess, Live More*

Percentage used for 95% Rule* 0

Bernicke Spending Reductions*

Current Age (for scheduling Bernicke spending reductions)* 48

Starting Portfolio 50,000

Percent in Stocks 90%

Expense Ratio 0.04%

Retirement Year* 2032

Contributions until then* 65,000

Social Security* 0

Starting in* 2035

Spouse Social Security* 0

Starting in* 2037

Other withdrawal change* +0

Starting in* 2025

Inflation adjusted* yes

Other withdrawal change* +0

Starting in* 2027

Inflation adjusted* yes

Other withdrawal change* +0

Starting in* 2031

Inflation adjusted* yes

Lump sum change to portfolio* +135,000

In year 2032

Lump sum change to portfolio* +75,000

In year * 2032

Lump sum change to portfolio* +0

In year * 2040

Inflation Rate selected* CPI

Fixed income model * LongInterest

Override start year* 1871

Terminal Value* 0

US Micro Cap** 10

US Small** 10

US Small Value** 10

S&P 500** 40

US Large Value** 40

US LT Treasury** 10

LT Corporate Bond** 15

1 Month Treasury** 5

and select "Given a success rate, determine spending level for a set portfolio, or portfolio for a set spending level" in the Investigate tab, I'm getting a flat line in the resulting graph (see attachment) that is only showing very low spending levels:

If I increase the "starting portfolio" value to something high enough, then the resulting graph makes more sense.

Any idea why this is happening?