Here is another illustration as to why a dividend is a wash without share price growth

you have 100 dollars in a stock paying a 10% dividend .

the stock goes ex div and a mandatory drop by the same amount has to happen before the stock trades , no different then a fund .

so you have 90 dollars left working for you for markets to work on and 10 dollars in hand .

great news , your stock doubled , they cured covid so you have 180 dollars invested .and 10 dollars in hand ...

so that is 190 dollars .

if instead of keeping the 10 dollars you reinvest it , you have more shares at a lower price which now equals the 100 dollars you had before the stock went ex div . if it doubles you have 200 dollars

if the stock didnt payout and still had the same 100 and it doubled you have the same 200 dollars .

there is no difference , its a wash,

here is at&t as an example

https://finance.yahoo.com/quote/T/history

on 4/12 it closed at 19.56 ... it paid a .278 cent dividend , the price was adjusted down to 19.28 ....

the stock opened at 19.12 which is the dividend less market action over night or after hours once it went ex div . .

so if you had 1000 shares you closed on 4/12 at 19,560 dollars .

the price was adjusted down to 19,280 dollars and you had the dividend in hand .

if instead of falling , markets doubled your stock price , you would have 38,560.00

if you reinvested you would have approx 39,120

if the stock never went ex div you would have no adjustment and the same 39,120 if it doubled.

of course while funds reinvest over night stocks usually lag so your reinvested price may vary a bit but the mechanics are the same .... for the most part its a wash reinvesting , you are only penalized if you dont reinvest so you have the same amount compounding for you.

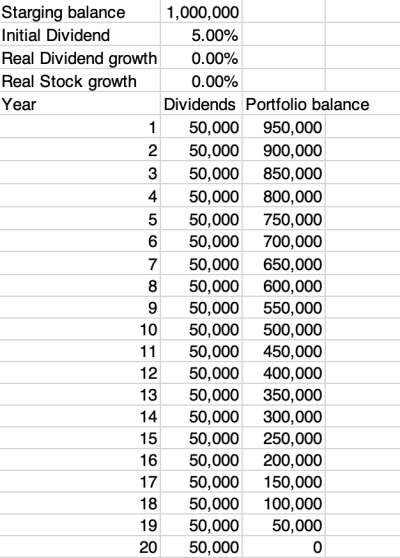

anyone can create the same exact cash flow from non div payers or a portfolio