TromboneAl

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 30, 2006

- Messages

- 12,880

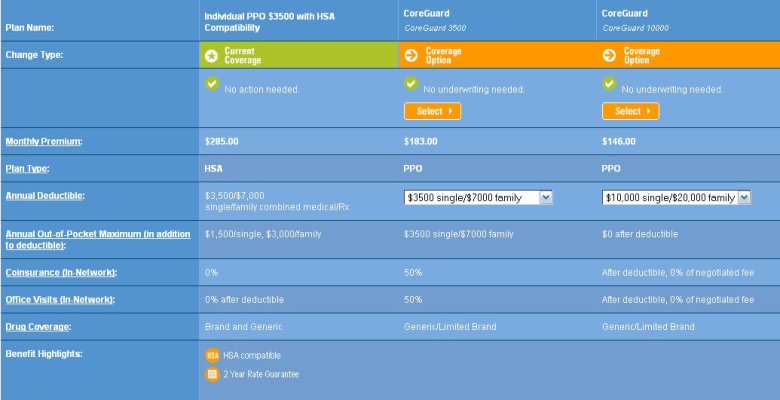

Since we're spending after tax dollars right now, there is much less benefit to an HSA plan. That is, being able to deduct three thousand dollars of HSA contributions per year doesn't save that much. At best it just means that we can do three thousand dollars more of a Roth conversion and pay no taxes on it.

So I'm considering changing to the non-HSA plan shown in this comparison.

Pros for switching:

Save $1,000/year or $1,600 in premiums

Cons for switching:

No more HSA

If I go over the deductible, I could be out $7K or $10K in one year as opposed to $5K

Drug coverage isn't as good

Your thoughts? Thanks!

So I'm considering changing to the non-HSA plan shown in this comparison.

Pros for switching:

Save $1,000/year or $1,600 in premiums

Cons for switching:

No more HSA

If I go over the deductible, I could be out $7K or $10K in one year as opposed to $5K

Drug coverage isn't as good

Your thoughts? Thanks!