golfnut

Full time employment: Posting here.

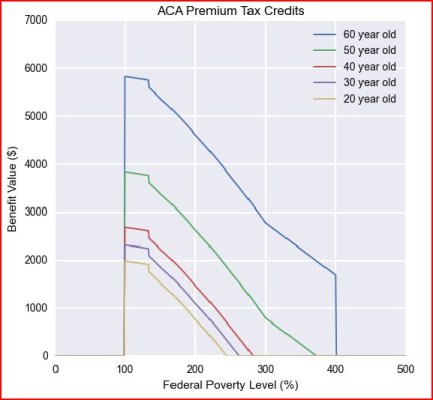

Can somebody explain reasons why there is a aca income cliff. For example for a family size of 2's income is over $63,xxx, the subsidy is zero but if slightly under, it's apprx. $300.

Just want to know the logic of this and why it's not a gradual decrease based on income over $63,xxx? Maybe there is no logic.

Also, if one is withdrawing pretax from a 401 k, is there any way of reducing the magi besides hsa contributions and ira contributions?

Just want to know the logic of this and why it's not a gradual decrease based on income over $63,xxx? Maybe there is no logic.

Also, if one is withdrawing pretax from a 401 k, is there any way of reducing the magi besides hsa contributions and ira contributions?