But this was changed with the 2016 Notice of Benefit and Payment Parameters. That regulation clarified that starting in 2016 (for plans that are not grandfathered or grandmothered), no individual can be required to pay more than the individual out-of-pocket maximum, even if the individual is enrolled in a family health insurance plan.

Under the new rules, no single member of a family can be required to pay more than $6,850 in out-of-pocket charges in 2016, regardless of whether the rest of the family has incurred any claims. This includes people enrolled in family HDHPs, and HHS has clarified that this does not conflict with HSA and HDHP requirements.

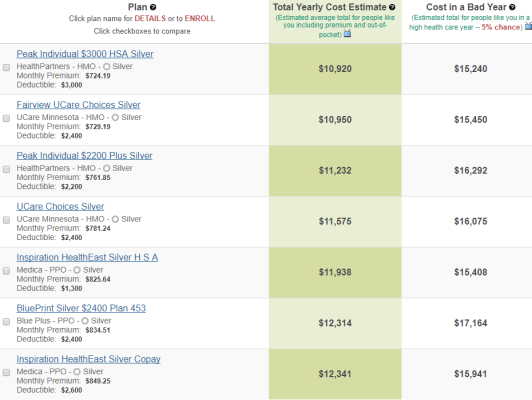

If you’re browsing plans in the exchange, in many states they only show family deductibles and OOPMs on the multi-plan comparison screen if you enter information for more than one family member. So you may need to look a little further to see what the individual OOPM is. In 2016, it won’t exceed $6,850, and in 2017, it won’t exceed $7,150.

But as long as you have an ACA-compliant health plan, you can rest assured that if a only one member of your family needs extensive medical care during the year, your out-of-pocket costs will be capped at no more than $6,850 in 2016, even if your plan has a family OOPM of $13,700.

Reference:

https://www.healthinsurance.org/faq...hat-full-deductible-even-for-just-one-person/