Cobra ending on the 30th of this month November. Consequently I need to enroll in Open Market ACA for one month of 21' and then turn round and and re enroll for 2022'.

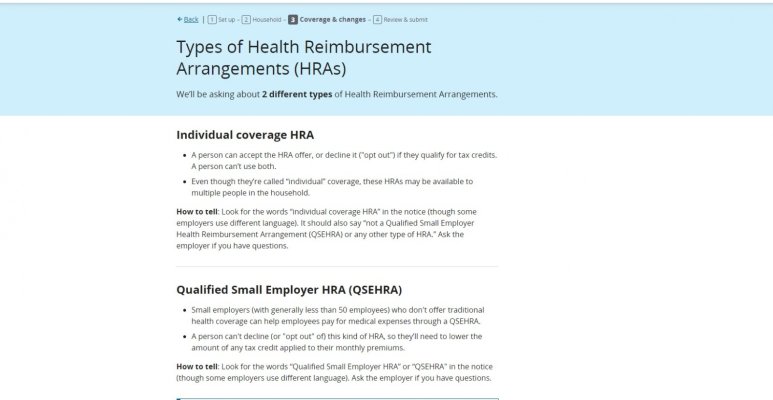

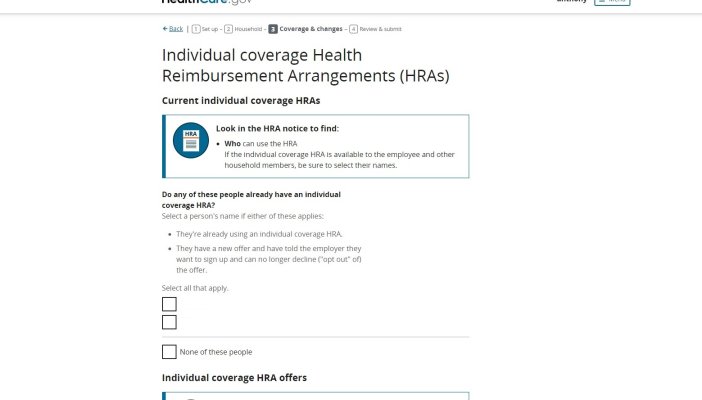

Never been through Open Enrollment through Healthcare.Gov they are asking specific questions regarding my HRA Account thru my former employer.

MC automatically enrolled me into the plan on 6/1/2020 - news to me as I always was under the impression the HRA would not be accessible until I turned 65 (normal retirement) per MC. That being said premium tax credits are on the table now for 21' & 22'. I am findinding out the HRA will prevent me from taking advantage of the PTC.

Enter plan/action A - I submitted all of my expenses for insurance premiums since starting Cobra to the administrator of the HRA account and they approved and paid out the expenses - which by the exceeded the available balance of the HRA account. I did this by design - hoping it's not a mistake on my part so I could go back and amend my approved application 2021' @ Healthcare.Gov and update the part where it asks for HRA information.

My hope is since I have liquidated the account it will be considered closed and I can take advantage of PTC for 2021' and 2022'.

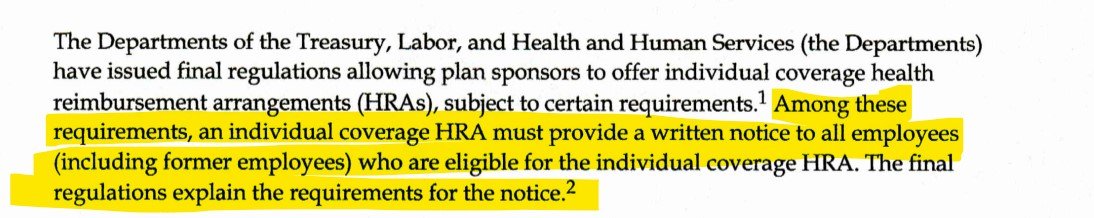

Here is the "meat" of the discussion. Going through the application process the site asks for specific info regarding the HRA. What I have learned since beginning this process 30 days ago I was supposed to receive an HRA Notice - according to the IRS site - from my employer upon retirement detailing the HRA in order to complete the application process accurately.

Unfortunately I did not receive this notice and if I did would have kept copies of it at the time of retirement. I think retiring in the middle of 2021 things may have gotten behind/slipped through the cracks or perhaps lost in the mail in any case I did not receive the notice.

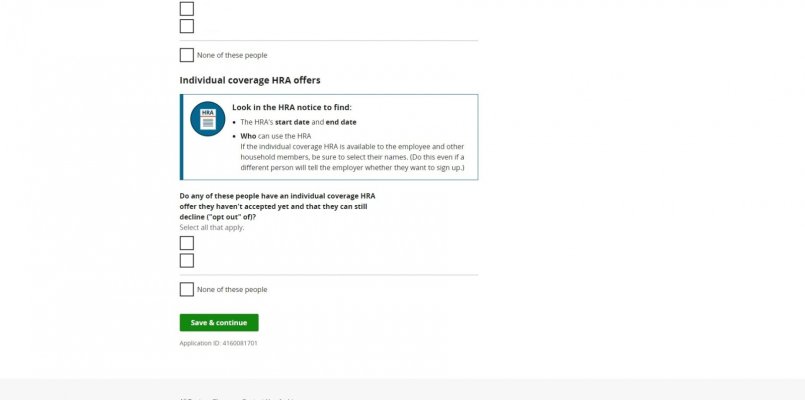

Some of the screen shots I have from the HC.Gov site ask about start and end date regarding the HRA. First time through naturally I answered I had an HRA and the site moved along and didn't ask about a start and end date.

My question to anyone who may have been through this is specifically about the start and end date of the HRA the site asks about. Could I "simply" for the start date enter the day Cobra started and for the end date the day the account was liquidated upon claim submissions?

In the meantime I have submitted request with MC for the actual notice. I get the feeling they know nothing about it and will be escalating the issue to a supervisor within days since I need to wrap this chore up and get on with retirement

Apologies for the long read.

Thanks for any suggestions or help.

My bad - proofreading I retired 6/01/2020

Never been through Open Enrollment through Healthcare.Gov they are asking specific questions regarding my HRA Account thru my former employer.

MC automatically enrolled me into the plan on 6/1/2020 - news to me as I always was under the impression the HRA would not be accessible until I turned 65 (normal retirement) per MC. That being said premium tax credits are on the table now for 21' & 22'. I am findinding out the HRA will prevent me from taking advantage of the PTC.

Enter plan/action A - I submitted all of my expenses for insurance premiums since starting Cobra to the administrator of the HRA account and they approved and paid out the expenses - which by the exceeded the available balance of the HRA account. I did this by design - hoping it's not a mistake on my part so I could go back and amend my approved application 2021' @ Healthcare.Gov and update the part where it asks for HRA information.

My hope is since I have liquidated the account it will be considered closed and I can take advantage of PTC for 2021' and 2022'.

Here is the "meat" of the discussion. Going through the application process the site asks for specific info regarding the HRA. What I have learned since beginning this process 30 days ago I was supposed to receive an HRA Notice - according to the IRS site - from my employer upon retirement detailing the HRA in order to complete the application process accurately.

Unfortunately I did not receive this notice and if I did would have kept copies of it at the time of retirement. I think retiring in the middle of 2021 things may have gotten behind/slipped through the cracks or perhaps lost in the mail in any case I did not receive the notice.

Some of the screen shots I have from the HC.Gov site ask about start and end date regarding the HRA. First time through naturally I answered I had an HRA and the site moved along and didn't ask about a start and end date.

My question to anyone who may have been through this is specifically about the start and end date of the HRA the site asks about. Could I "simply" for the start date enter the day Cobra started and for the end date the day the account was liquidated upon claim submissions?

In the meantime I have submitted request with MC for the actual notice. I get the feeling they know nothing about it and will be escalating the issue to a supervisor within days since I need to wrap this chore up and get on with retirement

Apologies for the long read.

Thanks for any suggestions or help.

My bad - proofreading I retired 6/01/2020

Last edited: