Looking ahead to Medicare in mid-2022:

I have an HSA with about $30K in it, and will add another $6K or so before hitting Medicare in July 2022. I do not plan to take SS until I'm 70.

My intent is to use the HSA funds to pay my Medicare Part B and Part D premiums. I expect to be in the IRMAA level 1 group. For at least the first few years I will use a Medigap policy rather than Medicare Advantage.

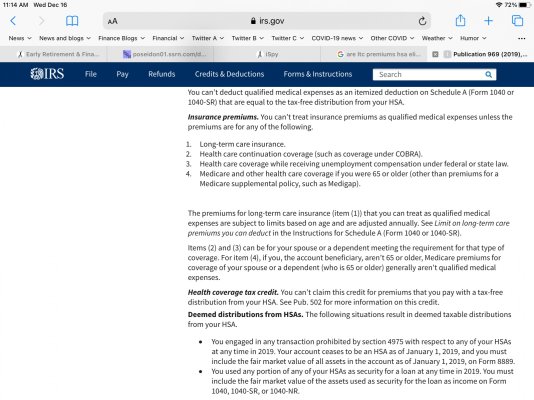

I may also use my HSA to pay my long term care premium (about $1500/year) if that is allowed -- I'm finding conflicting information on that.

So, first: do I understand the rules correctly, that I may use HSA funds to pay some Medicare premiums?

Second: the HSA , recently transferred to Fidelity from HSAdministrators, is currently sitting in cash. How would you invest it knowing that there will be systematic withdrawals starting 18 months from now? (At HSAdministrators it was in a VG life-cycle fund).

Thanks!

I have an HSA with about $30K in it, and will add another $6K or so before hitting Medicare in July 2022. I do not plan to take SS until I'm 70.

My intent is to use the HSA funds to pay my Medicare Part B and Part D premiums. I expect to be in the IRMAA level 1 group. For at least the first few years I will use a Medigap policy rather than Medicare Advantage.

I may also use my HSA to pay my long term care premium (about $1500/year) if that is allowed -- I'm finding conflicting information on that.

So, first: do I understand the rules correctly, that I may use HSA funds to pay some Medicare premiums?

Second: the HSA , recently transferred to Fidelity from HSAdministrators, is currently sitting in cash. How would you invest it knowing that there will be systematic withdrawals starting 18 months from now? (At HSAdministrators it was in a VG life-cycle fund).

Thanks!