Entertaining leaving COBRA for a higher deductible, low cost plan.

Current COBRA (Blue Cross Plan) plan is $1650/mo for a family of 4. $700 per person deductible and $4k per person annual max.

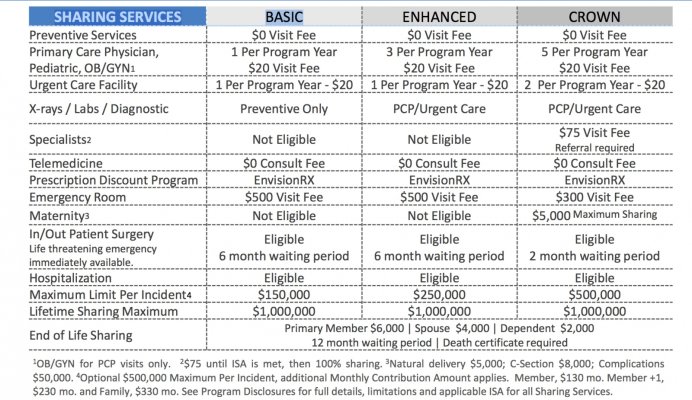

Agent Proposed "Crown" Plan is $880/mo with similar co-pays but a $5k deductible/max per individual for major surgeries/hospital stays. Emergency Room coverage is actually only $300 and 100% after, so that's better than current.

For over $9k a year in savings... why wouldn't I switch and take on the deductible risk?

I am new to this... what am I missing? My family is healthy and only one on going prescription which is the same in either plan.

Thanks!

Dog

Current COBRA (Blue Cross Plan) plan is $1650/mo for a family of 4. $700 per person deductible and $4k per person annual max.

Agent Proposed "Crown" Plan is $880/mo with similar co-pays but a $5k deductible/max per individual for major surgeries/hospital stays. Emergency Room coverage is actually only $300 and 100% after, so that's better than current.

For over $9k a year in savings... why wouldn't I switch and take on the deductible risk?

I am new to this... what am I missing? My family is healthy and only one on going prescription which is the same in either plan.

Thanks!

Dog