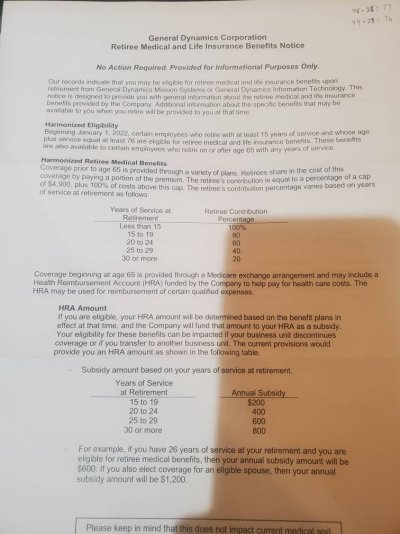

Just received this today (see picture). First time in my career (age 45) I've ever heard of possibly having retiree health insurance. Therefore it's not something I'm too familiar with.

I'm speculating this benefit was added to keep us mid-career folks around since tech is so hot right now. Certainly never had this benefit at any other time.

Anyway, if I'm reading this correctly, it is saying that health insurance is provided once the rule of 76 is achieved, and then I'll have to pay a graduating percentage of the premiums? Up to age 65 when medicare takes over, and even then there will be a small yearly payout.

This certainly would keep me around for a few more years.

View attachment 40638

I'm speculating this benefit was added to keep us mid-career folks around since tech is so hot right now. Certainly never had this benefit at any other time.

Anyway, if I'm reading this correctly, it is saying that health insurance is provided once the rule of 76 is achieved, and then I'll have to pay a graduating percentage of the premiums? Up to age 65 when medicare takes over, and even then there will be a small yearly payout.

This certainly would keep me around for a few more years.

View attachment 40638

Last edited: