I would like some feedback on wether or not this is a reasonable approach and/or suggestions for a "better" idea.

background:

As a "lean FIRE" that was involuntarily retired in 2016 at 55yo, I don't have any room to screw this up, so I'd classify myself as extremely risk averse.

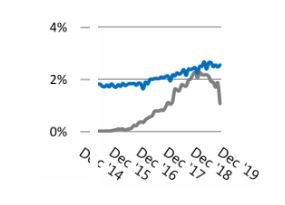

I've had my 401K representing about 1/3 of my net worth sitting in a Stable Value Fund which has now dropped to 2.14% per year. The SVF might creep back up, it might not. I expect rates to whipsaw lower "sooner rather than later" thus I doubt the SVF will get to current CD/Treasury/Agency levels before the elevator goes back down. FYI the SVF is the only fund out of more than 200 available in the 401k hasn't lost value YTD.

Currently:

10 year brokered CDs are 3.7% (update: 10yr sold out/unavailable today). 20yr Agency/GSE bonds are at 5% (update: now down to 4.56%) (but agency bonds all appear to be callable)

The idea:

I'm thinking of rolling my 401K to my IRA and just plop it into either longer CDs or Treasuries/Agencies with a few shorter durations laddered in for tax/income managment between now and RMD time in 10.5 years. This is a one-way street as once the $ is out of the 401K it can't go back in and SVFs aren't available outside of the 401K.

Long term CD/Treasuries wouldn't be a flexible as the SVF, but other than tax/ACA management of income I don't see us needing to do a big withdrawal on the horizon. (I might have to spike income taxes to take advantage of a solar tax credit, but I can keep 10% of the 401K transfer in real short duration to cover that).

What say you? keep it in the 401K SVF or move it to an IRA for longer term CD/Treasuries? Or?

background:

As a "lean FIRE" that was involuntarily retired in 2016 at 55yo, I don't have any room to screw this up, so I'd classify myself as extremely risk averse.

I've had my 401K representing about 1/3 of my net worth sitting in a Stable Value Fund which has now dropped to 2.14% per year. The SVF might creep back up, it might not. I expect rates to whipsaw lower "sooner rather than later" thus I doubt the SVF will get to current CD/Treasury/Agency levels before the elevator goes back down. FYI the SVF is the only fund out of more than 200 available in the 401k hasn't lost value YTD.

Currently:

10 year brokered CDs are 3.7% (update: 10yr sold out/unavailable today). 20yr Agency/GSE bonds are at 5% (update: now down to 4.56%) (but agency bonds all appear to be callable)

The idea:

I'm thinking of rolling my 401K to my IRA and just plop it into either longer CDs or Treasuries/Agencies with a few shorter durations laddered in for tax/income managment between now and RMD time in 10.5 years. This is a one-way street as once the $ is out of the 401K it can't go back in and SVFs aren't available outside of the 401K.

Long term CD/Treasuries wouldn't be a flexible as the SVF, but other than tax/ACA management of income I don't see us needing to do a big withdrawal on the horizon. (I might have to spike income taxes to take advantage of a solar tax credit, but I can keep 10% of the 401K transfer in real short duration to cover that).

What say you? keep it in the 401K SVF or move it to an IRA for longer term CD/Treasuries? Or?